You are evaluating the profitability potential of a process and have the following information. The criterion for

Question:

You are evaluating the profitability potential of a process and have the following information. The criterion for profitability is a 15% rate of return over ten operating years. The equipment has zero salvage value at the end of the project.

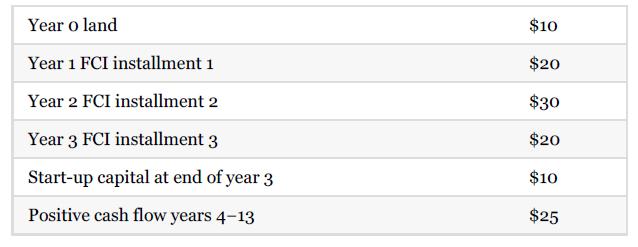

Fixed capital investment (including land) in four installments (all values are in millions of dollars as one transaction at the end of the year):

1. Draw a discrete, discounted cash flow diagram for this process.

2. Draw a cumulative, discounted cash flow diagram for this process.

3. What is the present value (at end of year 0) for this process?

4. What is the future value at the end of year 13?

5. What would the effective annual interest rate have to be so that the present value (end of year 0) of this investment is zero? (This interest rate is known as the DCFROR, and it will be discussed in the next chapter.)

6. What is your recommendation regarding this process? Explain.

Step by Step Answer:

Analysis Synthesis And Design Of Chemical Processes

ISBN: 9780134177403

5th Edition

Authors: Richard Turton, Joseph Shaeiwitz, Debangsu Bhattacharyya, Wallace Whiting