Your company is considering investing in a process improvement that would require an initial capital investment of

Question:

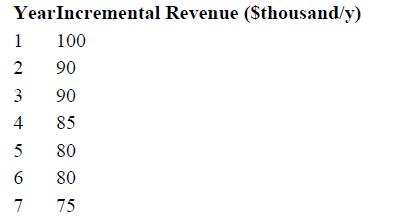

Your company is considering investing in a process improvement that would require an initial capital investment of $500,000. The projected increases in revenue over the next seven years are as follows:

The company can always leave the capital investment in the stock portfolio, which is projected to yield 8% p.a. over the next seven years. What should the company do?

What is the break-even rate of return between the process improvement and doing nothing?

If the capital investment could be changed without changing the incremental revenues, what capital investment changes this investment from being profitable (not profitable) to being not profitable (profitable)?

Step by Step Answer:

Analysis Synthesis And Design Of Chemical Processes

ISBN: 9780134177403

5th Edition

Authors: Richard Turton, Joseph Shaeiwitz, Debangsu Bhattacharyya, Wallace Whiting