Tia is discussing with Rory and Leigh the risks they identified and how this information will be

Question:

Tia is discussing with Rory and Leigh the risks they identified and how this information will be used in the audit risk model. Tia comments, ‘The audit risk model provides us with a guide for our audit strategy based on our assessments of inherent risk and control risk, and Felix’s decision on what the level of audit risk should be.’

Leigh is confused about audit risk — she knows that audit risk is the risk that the auditor issues the wrong audit report, or gives an inappropriate audit opinion, and that this risk is related to the client’s circumstances. But, she asks, what does ‘low audit risk’ mean in practice and in comparison to ‘high audit risk’?

Tia responds, ‘For a new client, where we know relatively little about the entity, we’ll usually set our audit risk to low. We want the lowest possibility that we issue the wrong audit opinion. What other types of clients would have large implications for AuditTek (both for our reputation and financially) if we gave the wrong audit opinion?’

Leigh answers, ‘Maybe publicly listed clients? An issue with one of their audits may result in a lot of media coverage and a lawsuit from their shareholders could be quite costly. But in what circumstances would our audit partner assign a high level of audit risk?’

Tia acknowledges that this is a great question and says, ‘High audit risk doesn’t mean we’re going to be lax in our duties as auditors. It would only be assigned in circumstances where we’re confident that we know where misstatements are likely to be and that we can identify them. For example, think about a smaller client that makes the same mistakes in their accounting every year and doesn’t change their internal controls — in that instance we may be willing to set audit risk at medium or high. We’d then still be vigilant and apply our professional scepticism and follow the auditing standards.’

She explains that AuditTek uses a low, medium and high rating for each component of the audit risk model, not percentages, because ratings are subjective — they are influenced by each individual’s previous audit experiences and training. However, Leigh still looks confused. ‘Let’s break this down,’ Tia says. ‘Auditors face the risk of stating that in their opinion the financial report is not materially misstated, when in fact it is. So, how does a material misstatement get into the published financial report?’

Leigh works through the logic. ‘First, the error has to be created, either by accident or on purpose. Second, the client’s control system must have failed to prevent the error getting into the accounts and failed to detect the error once it was in the system. And, finally, the auditor had to fail to find the error during the audit.’

‘Correct!’ says Tia. ‘Now, before we go on, I want to break down the idea of “financial report” too. A financial report is the balance sheet (statement of financial position), income statement (statement of comprehensive income), cash flow statement (statement of cash flows), statement of changes in equity and all the notes. So, when we talk of the risk of misstatements, we’re referring to the risk of misstatement in every line item in each of these statements. If we focus on just one line in a balance sheet — say, debtors — what are the possible misstatements that could occur?’

Leigh tries to work through the logic again. ‘The amount could be either understated or overstated. I suppose there are lots of errors that could occur. Obviously, basic adding-up mistakes and other clerical errors could affect the total in either direction. In addition, debtors would be understated if management omitted some debtors when they calculated the total. I think the deliberate “mistakes” are more likely to overstate debtors because that makes the balance sheet look better, and probably means profit is overstated too. Debtors would be overstated if some of the debtors claimed in the total didn’t exist at year-end, or didn’t belong to the client entity, or were overvalued because bad debts were not written off, or sales from the next period were included in the earlier period.’

‘Very good,’ says Tia. ‘It’s the same for every line item. Every time management prepares a financial report, they assert that all these errors did not occur — that all the individual items in the report are not materially misstated. The auditor has to break down the financial report audit into accounts and assertions and consider the risk of misstatement for each assertion for each account. The auditor deals with the risk of material misstatement of the entire financial report by gathering evidence at the assertion level for each account. Then all the evidence is put together so the auditor can form an opinion on the overall financial report. Now, let’s see how this works for Crest Outfitters.’

MATERIALITY

Tia has asked you to calculate the planning materiality for Crest Outfitters. This isn’t a task that you’ve completed before. You know that the audit is looking for ‘material’ misstatements — not every error.

Tia says, ‘Setting the planning materiality is important, as it helps us decide what errors or misstatements we’ll be asking Crest management to adjust. If it’s set at a low value, we’ll have to plan to gather more and better quality evidence to be sure that a mistake of this low magnitude hasn’t occurred.

‘If we set planning materiality too high, we could potentially give the wrong opinion and leave a misstatement in the financial statements; if we set planning materiality too low, we may end up asking the client to adjust items that won’t be useful or impactful for decision-making. We also need to consider the level of risk at the client — as the risk of misstatements increases, we need to decrease our materiality.’ Leigh asks, ‘So how do we know what the correct materiality level is?’

Tia responds, ‘There’s no absolutely correct number for materiality — it’s a professional judgement, and Felix and I have to use our experience to make a judgement about what’s appropriate given our understanding of the nature of the client and their potential risks. We first need to start with choosing the best base for our materiality and then apply an appropriate percentage. If new information comes to light during the audit, we can adjust our materiality at any time. This responsiveness is important in any audit — we don’t want to get stuck in a rigid plan that doesn’t change when circumstances do.’

Required

(a) In a group, based on what you know, make preliminary assessments for the levels of inherent risk and control risk, selecting from low, medium or high. Justify your choice. Then add your inherent risk and control risk assessments to the audit risk model (remember that Felix has set audit risk as low) to determine the level of detection risk.

(b) AuditTek commenced planning the Crest Outfitters audit by gaining an understanding of the client’s structure and its business environment. A major task is to consider the concept of materiality as it applies to the client. The auditor will design procedures in order to identify and correct errors or irregularities that would have a material effect on the financial report and affect the decision-making of the users of the financial report. Materiality is used in determining audit procedures and sample selections, and evaluating differences from client records to audit results. It is the maximum amount of misstatement, individually or in aggregate, that can be accepted in the financial report. In selecting the base figure to be used to calculate materiality, an auditor should consider the key drivers of the business.

Crest is in an unusual situation in that it doesn’t have external shareholders or banks that have lent it funds. Instead, Crest’s shareholders are employees of the entity. What are they going to be looking at? Will it still be profitability? If Crest becomes unprofitable, employees will be out of a job. However, for many, working at Crest is their passion as well as their job.

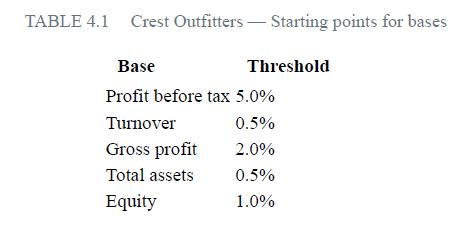

AuditTek’s audit methodology dictates that one planning materiality amount is to be used for the financial report as a whole (that is, rather than using separate planning materiality amounts for the income statement and the balance sheet). Further, only one basis should be selected — a blended approach or average should not be used. The basis selected is the one determined to be the key driver of the business. AuditTek uses the percentages in table 4.1 as starting points for the various bases.

These starting points can be increased or decreased by taking into account qualitative client factors, which could be:

• The nature of the client’s business and industry (for example, rapidly changing, either through growth or downsizing, or an unstable environment)

• If the client is a listed entity (or a subsidiary of one) subject to regulations

• The knowledge of or high risk of fraud.

Typically, profit before tax is used; however, it cannot be used if reporting a loss for the year, if profitability is impacted significantly by ‘one off’ adjustments or transactions, or if the users of the financial report are not basing their investment (or other) decisions on a profit basis.

Based on your understanding of Crest Outfitters, select the appropriate base and the percentage you would use for calculating materiality. Does this percentage need to be adjusted?

Use the financial statements provided in parts c and d.

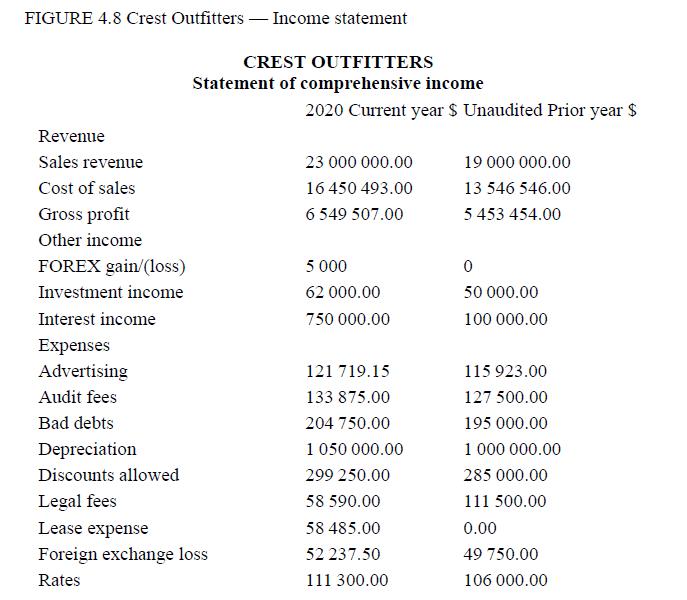

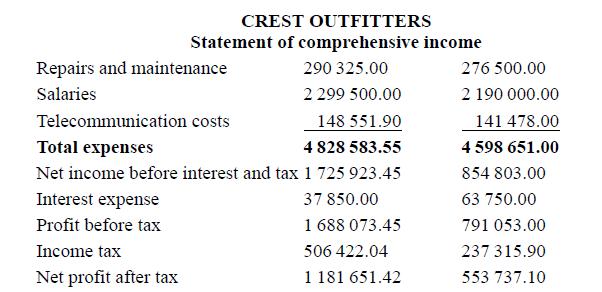

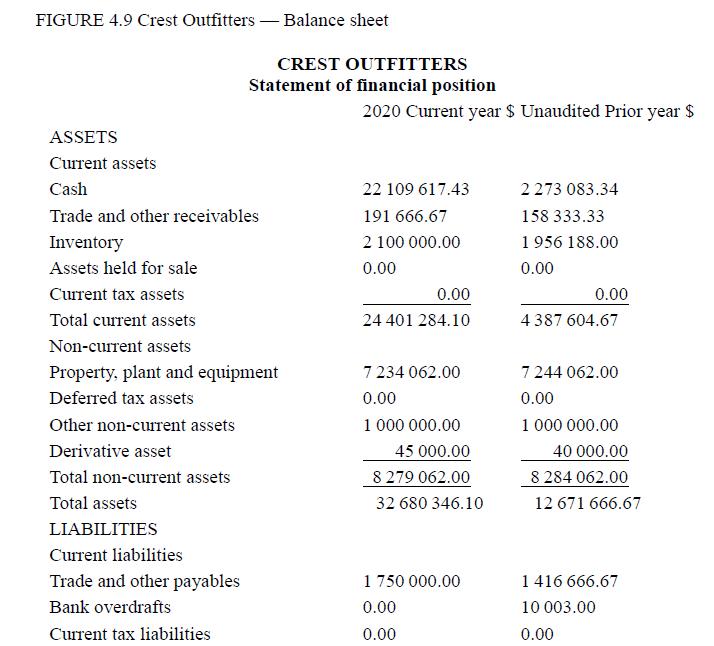

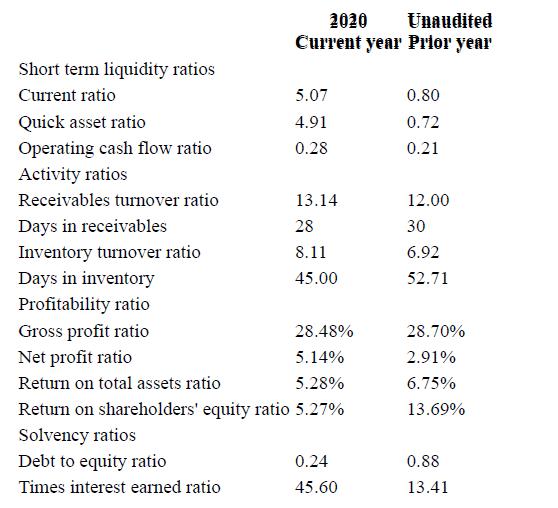

(c) While brainstorming and understanding the client is one of the ways AuditTek identifies the risks of material misstatement and significant risks, the firm also uses quantitative methods as a secondary method of identifying risks. This is because some risks may be more easily identified because of an unusual trend in an account value or unusual fluctuation or movement in a ratio.

Leigh has prepared the analytical procedures based on the financial statements Crest Outfitters has provided. Tia has asked you (Rory) to review the analytical procedures and identify whether there are any ratios that indicate an account is at greater risk of misstatement. List these ratios and justify your choices. You should take into account information about Crest Outfitters that is contained in earlier chapters and your earlier responses. Figure 4.8 shows the income statement for 2020 and 2019.

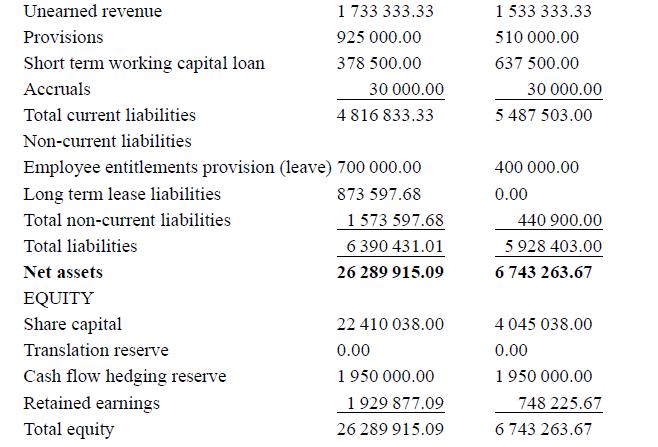

Figure 4.9 shows the balance sheet for 2020 and 2019 and figure 4.10 shows a ratio analysis.

![]()

(d) You’ve now identified risks through a number of different exercises. In this chapter we learned that ASA 315 (ISA 315) asks auditors consider the risks at the financial reporting level and at the assertion level. The next task is to collate all of the risks of material misstatement that you’ve identified and class them as financial reporting or assertion-level risks of material misstatement.

Step by Step Answer:

Auditing A Practical Approach

ISBN: 9780730382645

4th Edition

Authors: Robyn Moroney, Fiona Campbell, Jane Hamilton