The following information was obtained in an audit of the cash account of Tuck Company as of

Question:

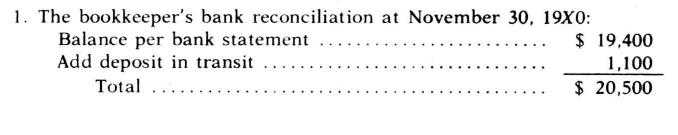

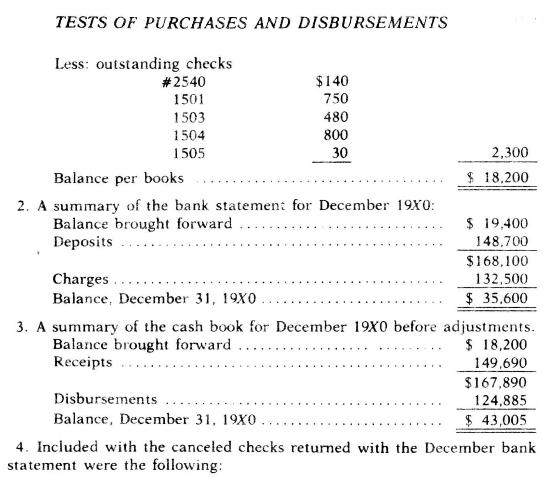

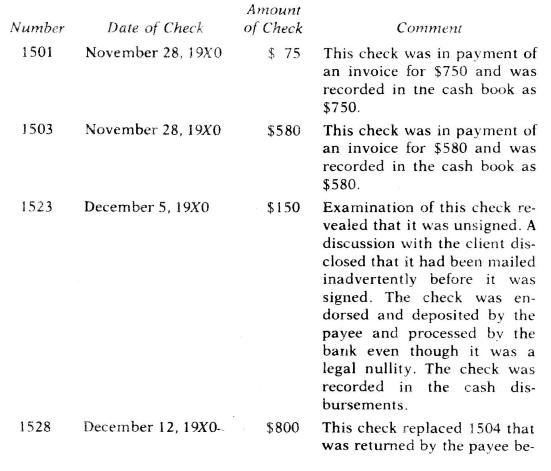

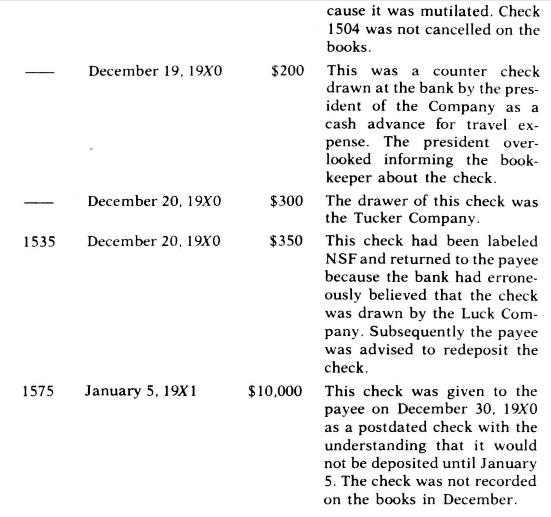

The following information was obtained in an audit of the cash account of Tuck Company as of December 31, 19X0. Assume that the CPA has satisfied himself as to the validity of the cash book, the bank statements and the returned checks, except as noted.

5. The Tuck Company discounted its own sixty-day note for \(\$ 9,000\) with the bank on December 1, 19X0. The discount rate was 6 percent. The bookkeeper recorded the proceeds as a cash receipt at the face value of the note.

6. The bookkeeper records customers' dishonored checks as a reduction of ca:h receipts. When the dishonored checks are redeposited they are recorded as a regular cash receipt. Two NSF checks for \(\$ 180\) and \(\$ 220\) were returned by the bank during December. The \(\$ 180\) check was redeposited but the \(\$ 220\) check was still on hand at December 31 . Cancellations of Tuck Company checks are recorded by a reduction of cash disbursements.

7. December bank charges were \(\$ 20\). In addition a \(\$ 10\) service charge was made in December for the collection of a foreign draft in November. These charges were not recorded on the books.

8. Check 2540 listed in the November outstanding checks was drawn three years ago. Since the payee cannot be located, the president of Tuck Company agreed to the CPA's suggestion that the check be written back into the accounts by a journal entry.

9. Outstanding checks at December \(31,19 \times 0\) totaled \(\$ 4,000\) excluding checks 2540 and 1504.

10. The bank had recorded a deposit of \(\$ 2,400\) on January \(2,19 X 1\). The bookkeeper had recorded this deposit on the books on December 31, \(19 \times 0\) and then mailed the deposit to the bank.

Required:

Prepare a four-column reconciliation ("proof of cash") of the cash receipts and cash disbursements recorded on the bank statement and on the Company's books for the month of December 19X0. Use the format illustrated in this chapter.

Step by Step Answer:

Modern Auditing

ISBN: 9780471542834

5th Edition

Authors: Walter Gerry Kell, William C. Boynton, Richard E. Ziegler