Various types of accounting changes can affect the second reporting standard of the generally accepted auditing standards.

Question:

Various types of "accounting changes" can affect the second reporting standard of the generally accepted auditing standards. This standard reads, "The report shall state whether such principles have been consistently observed in the current period in relation to the preceding period."

Assume that the following list describes changes which have a material effect on a client's financial statements for the current year.

1. A change from the completed-contract method to the percentage-of completion method of accounting for long-term construction contracts.

2. A change in the estimated useful life of previously recorded fixed assets based on newly acquired information.

3. Correction of a mathematical error in inventory pricing made in a prior period.

4. A change from prime costing to full absorption costing for inventory valuation.

5. A change from presentation of statements of individual companies to presentation of consolidated statements.

6. A change from deferring and a mortizing preproduction costs to recording such costs as an expense when incurred because future benefits of the costs have become doubtful. The new accounting method was adopted in recognition of the change in esimated future benefits.

7. A change to including the emplover share of FICA taxes as "retirement benefits" on the income statement from including it with "other taxes."

8. A change from the FIFO method of inventory pricing to the LIFO method of inventory pricing.

Required:

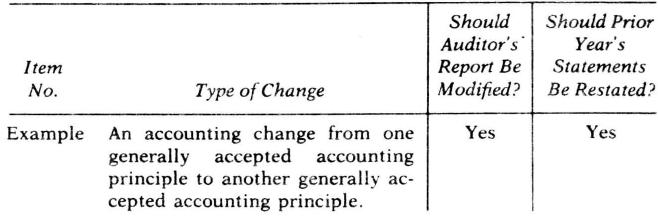

Identify the type of change which is described in each item above, state whether any modification is required in the auditor's report as it relates to the second standard of reporting, and state whether the prior year's financial statements should be restated when presented in comparative form with the current year's statements. Organize your answer sheet as shown below.

For example, a change from the LIFO method of inventory pricing to the FIFO method of inventory pricing would appear as shown below:

Step by Step Answer:

Modern Auditing

ISBN: 9780471542834

5th Edition

Authors: Walter Gerry Kell, William C. Boynton, Richard E. Ziegler