You are working on the audit of your client Sweetie Ltd for the year ended 31 March

Question:

You are working on the audit of your client Sweetie Ltd for the year ended 31 March 202X. The company employs 100 workers in a doughnut manufacturing plant. Wages are paid weekly. The following procedures are carried out:

• Employees clock cards are signed by supervisors and brought to the wage's office every Monday morning.

• Hours are taken from the cards. Overtime hours are calculated and entered on an overtime sheet which is then used to calculate overtime payments.

• The overtime sheet is authorized by the production manager.

• Wages are prepared using a standard computerized wages software package.

• Standard hours and overtime hours are entered into the payroll using the input screen.

• Any amendments to employees' details, e.g. changes of address or tax code, are entered on each employee's computer file by any of the wage's clerks.

• Details of any new starters are entered into the system by any of the wages clerks.

• Leavers are removed from the system once their final week's wages have been calculated.

• The payroll is processed and then authorized by the production manager.

• It is then passed to the accounts department who prepare BACs payments for each employee.

• Wages are paid on Friday, so the payroll has to be prepared in time to ensure employees are paid promptly.

Discussion

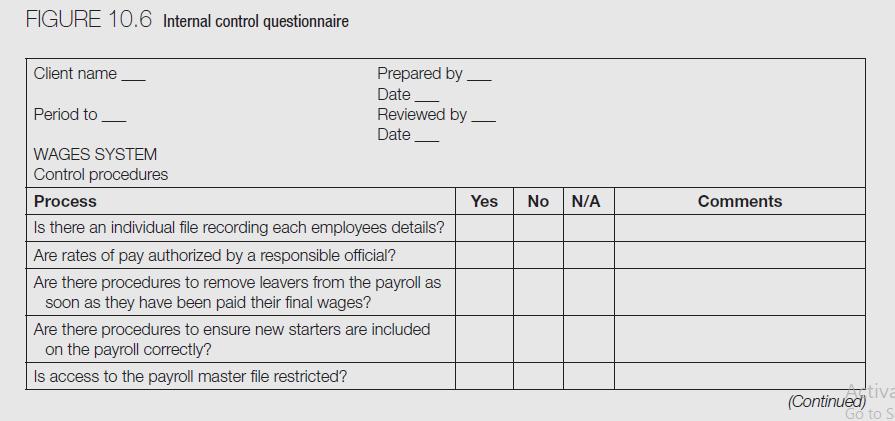

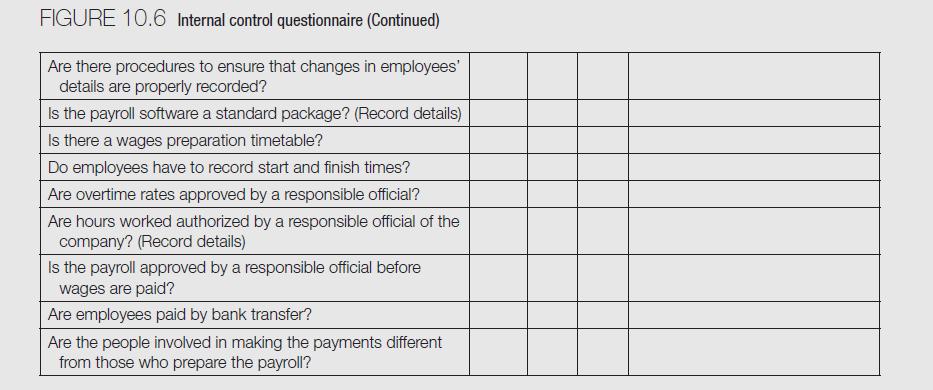

– The audit manager has asked you to complete the ICQ below (Figure 10.6) based on the payroll system details set out above.

Step by Step Answer: