For each of the accounts for Shady Oaks (1 and 2 above) identified to be a significant

Question:

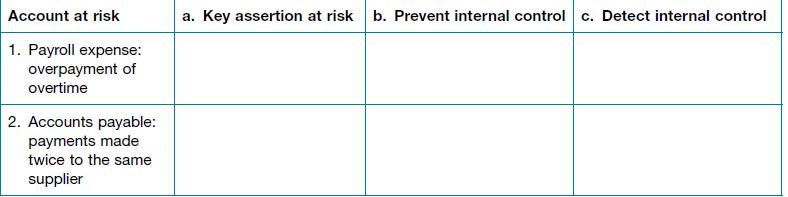

For each of the accounts for Shady Oaks (1 and 2 above) identified to be a significant risk:

(a) Determine the key assertion at risk

(b) Describe a practical prevent internal control that would directly address the risk

(c) Describe a practical detect internal control that Shady Oaks could implement in relation to the risk. You may wish to present your answer in the form of a table as follows.

In addition your business risk assessment procedures indicate there is a risk that payments to suppliers are made prior to goods being received. As part of your evaluation of the potential mitigating internal controls you note that accounting staff perform the following procedures.

1. A pre-numbered cheque requisition is prepared for all payments.

2. The details on the supplier’s invoice are matched to the appropriate receiving report.

3. The details on the supplier’s invoice and receiving report are matched to an authorised purchase order.

4. The cheque requisition is stapled to the authorised purchase order, receiving report and supplier’s invoice and forwarded to the appropriate senior staff member for review and authorisation.

5. The authorised cheque requisition, together with the supporting documents, is passed to accounts payable for payment.

Chan & Partners Chartered Accountants is a successful mid-tier accounting firm with a large range of clients across Australia. During the 2017 year, Chan and Partners gained a new client, Medical Services Holdings Group (MSHG), which owns 100 per cent of the following entities:

• Shady Oaks Hospital, a private hospital group • Gardens Nursing Home Pty Ltd, a private nursing home

• Total Cancer Specialists Limited (TCSL), a private oncology clinic that specialises in the treatment of cancer.

Year-end for all MSHG entities is 30 June.

You are an audit senior on the Shady Oaks Hospital engagement. Your initial review of the business has highlighted the following significant risks.

1. Payroll expense. Shady Oaks employs, in addition to its full-time staff, a significant number of casual nursing, cleaning and administrative staff. Overtime is often worked on weekends and night shifts due to a shortage of staff. Payment at overtime rates for standard weekend and night shifts has been a common occurrence.

2. Accounts payable. Shady Oaks also has a large number of suppliers for various medical supplies and drugs. Paying the supplier twice for the same purchase has been a continuing problem.

Step by Step Answer:

Auditing A Practical Approach

ISBN: 9780730364573

3rd Edition

Authors: Robyn Moroney, Fiona Campbell, Jane Hamilton