In its 1996 financial results, Sunbeam reported restructuring costs that did not comply with GAAP because they

Question:

In its 1996 financial results, Sunbeam reported restructuring costs that did not comply with GAAP because they included amounts for items that benefited future activities.3 These costs lowered Sunbeam’s reported 1996 net income. One possible motivation for executives to report higher costs in a given year is to make a company’s net income for the following year appear better by comparison.

Executives have also been known to report higher reserve levels in a given year and then use these reserves to increase income in a year that follows.

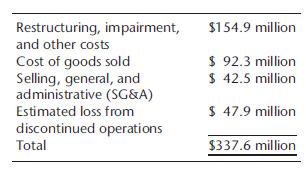

Associated with its operational restructuring, Sunbeam’s 1996 results included a pretax charge to earnings of \($337.6\) million, which was allocated as follows:

The “restructuring, impairment, and other costs” category included the following cash items: severance and other employee costs (\($43.0\) million), lease obligations and other exit costs associated with facility closures (\($12.6\) million), back office outsourcing start-up costs, and other costs related to the implementation of the restructuring and growth plan (\($7.5\) million). Noncash items in this category (\($91.8\) million) were related to asset write-downs for disposals of excess facilities and equipment, and noncore product lines; write-offs of redundant computer systems from the administrative back office consolidations and outsourcing initiatives; and intangible, packaging, and other asset write-downs related to exited product lines and SKU reductions.

Importantly, this amount also included approximately \($18.7\) million of items that benefited future activities, such as costs of redesigning product packaging, costs of relocating employees and equipment, and certain consulting fees.6 Inclusion of these items was not allowed under GAAP because these costs related to activities that benefited future periods.

Cost of Goods Sold, SG&A, and Estimated Loss from Discontinued Operations As part of its operational restructuring, Sunbeam sold the inventory of its eliminated products to liquidators at a substantial discount. As such, the cost of goods sold portion of the restructuring charge related principally to inventory write-downs and costs of inventory liquidation programs.

The SG&A portion of the restructuring charge related principally to increases in environmental, litigation, and other reserves. The litigation reserve was created for a lawsuit alleging Sunbeam’s potential obligation to cover a portion of the cleanup costs.......

Case Questions

1. What is meant by a restructuring reserve? As an auditor, what type of evidence would you want to examine to determine whether a company was inappropriately accounting for its restructuring reserve?

2. As an auditor, do you believe that the different components of the restructuring reserve might be subject to significantly differing levels of inherent risk? Why or why not?

3. Identify at least one relevant financial statement assertion related to the restructuring reserve account. Why is it relevant?

4. This case describes a situation where a company overstated its recorded expenses in 1996 (as compared to understating recorded expenses). Why would a company choose to overstate its expenses and understate its net income?

Step by Step Answer:

Auditing And Accounting Cases Investigating Issues Of Fraud And Professional Ethics

ISBN: 9780078110818

3rd Edition

Authors: Jay Thibodeau, Deborah Freier