You are the audit senior in charge of the audit of Blackburn Ltd., and you are auditing

Question:

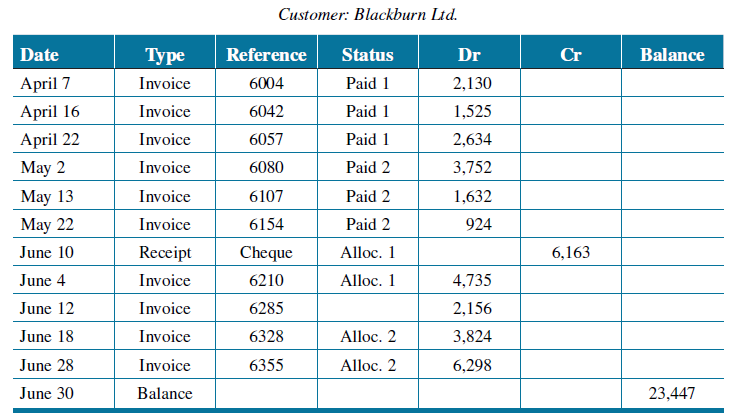

You are the audit senior in charge of the audit of Blackburn Ltd., and you are auditing the company’s trade creditors at December 31, 2020. A junior member of the audit team has been checking suppliers’ statements against the balances in the accounts payable sub-ledger. He is unable to reconcile a material balance relating to Whitebone Ltd., and has asked for your help and suggestions on the audit work that should be carried out on the differences. The balance of Whitebone in Blackburn’s sub-ledger is shown below

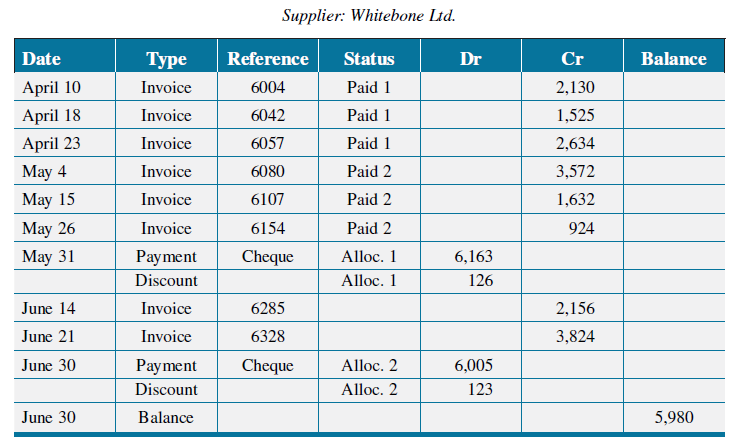

Below are the details on Whitebone’s suppliers’ statement.

Whitebone’s terms of trade with Blackburn allow a 2-percent cash discount on invoices where Whitebone receives a cheque from the customer by the end of the month following the date of the invoice (that is, a 2-percent discount will be given on November invoices paid by December 31). On Blackburn’s sub-ledger, under “Status,” the cash and discount marked “Alloc. 1” pay invoices marked “Paid 1” (similarly for “Alloc. 2” and “Paid 2”). Blackburn’s receiving department checks the goods when they arrive and issues a receiving report. A copy of the report is sent to the accounts payable department.

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive...

Step by Step Answer:

Auditing A Practical Approach

ISBN: 978-1119566007

3rd Canadian edition

Authors: Robyn Moroney, Fiona Campbell, Jane Hamilton, Valerie Warren