The accounting firm of Barnes and Fischer, LLP, is a medium-sized, national CPA firm. The partnership, formed

Question:

The accounting firm of Barnes and Fischer, LLP, is a medium-sized, national CPA firm. The partnership, formed in 1954, now has over 4,000 professionals on the payroll. The firm mainly provides auditing and tax services, but it has recently had success building the information systems consulting side of the business for non-audit clients and for audit clients that are not publicly traded.

It is mid-January 2019, and you are a newly promoted audit manager in an office of Barnes and Fischer, located in the Pacific Northwest. You have been a senior auditor for the past three of your five years with Barnes and Fischer. Your first assignment as audit manager is to assist an audit partner on a client acceptance decision. The partner explains to you that the prospective client, Ocean Manufacturing, is a medium-sized manufacturer of small home appliances. The partner recently met the company’s president at a local chamber of commerce meeting. The president indicated that, after some difficult negotiations, the company has decided to terminate its relationship with its current auditor. The president explained that the main reason for the switch is to build a relationship with a more nationally established CPA firm because the company plans to make an initial public offering (IPO) of its common stock within the next few years. Ocean’s annual financial statements have been audited each of the past 12 years in order to comply with debt covenants and to receive favorable interest rates on the company’s existing line of credit. Because the company’s December 31 fiscal year-end has already passed, time is of the essence for the company to contract with a new auditor to get the audit under way.

The partner, Jane Hunter, is intrigued with the idea of having a client in the home appliance industry, especially one with the favorable market position and growth potential of Ocean Manufacturing. Although there are several manufacturers of small home appliances in the area, your office has never had a client in the industry. Most of your office’s current audit clients are in the healthcare services industry. Thus, the partner feels the engagement presents an excellent opportunity for Barnes and Fischer to enter a new market. On the other hand, knowing the risks involved, the partner wants to make sure the client acceptance decision is carefully considered.

REQUIRED

[1] The client acceptance process can be quite complex. Identify five procedures an auditor should perform in determining whether to accept a client. Which of these five are required by auditing standards?

[2] What nonfinancial matters should be considered before accepting Ocean as a client? How important are these issues to the client acceptance decision? Why?

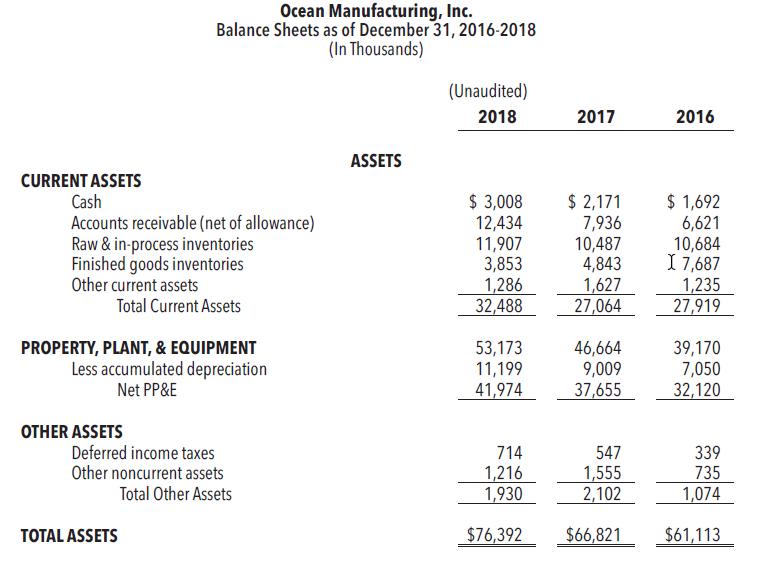

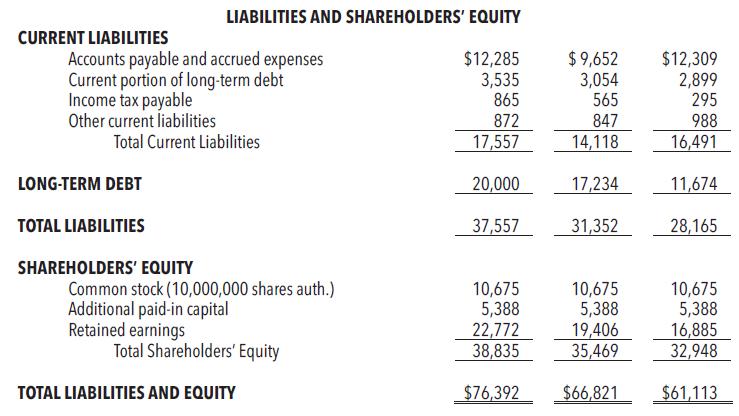

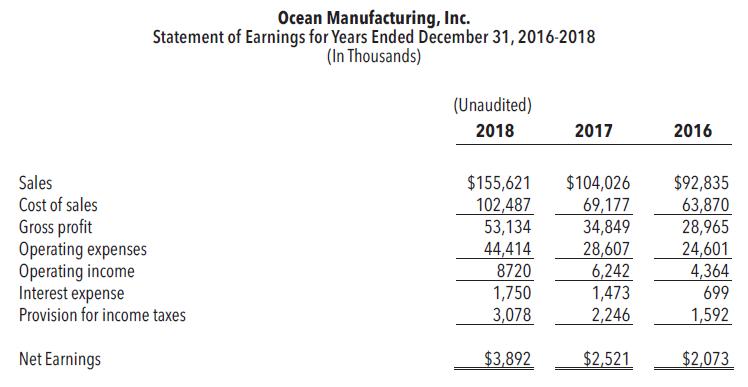

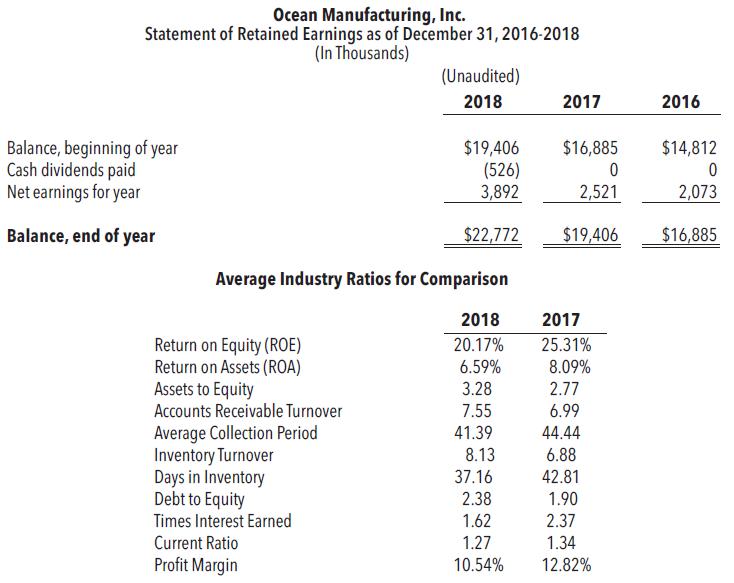

[3] Using Ocean’s financial information, below, calculate relevant preliminary analytical procedures to obtain a better understanding of the prospective client and to determine how Ocean is doing financially. Compare Ocean’s ratios to the industry ratios provided. Identify any major differences and briefly list any concerns that arise from this analysis in terms of how each might affect the client acceptance decision.

[4] [a] Ocean wants Barnes and Fischer to aid in developing and improving its IT system. What are the advantages and disadvantages of having the same CPA firm provide both auditing and consulting services? Given current auditor independence rules, will Barnes and Fischer be able to help Ocean with its IT system and still provide a financial statement audit? Support your conclusion with appropriate citations to authoritative standards if your instructor indicates that you should do so.

[b] As indicated in the case, one of the partners in another office has invested in a venture capital fund that owns shares of Ocean common stock. Would this situation constitute a violation of independence according to the AICPA Code of Professional Conduct? Why or why not?

[5] [a] Prepare a memo to the partner making a recommendation as to whether Barnes and Fischer should or should not accept Ocean Manufacturing, Inc. as an audit client. Carefully justify your position in light of the information in the case. Include consideration of reasons both for and against acceptance and be sure to address both financial and nonfinancial issues to justify your recommendation.

[b] Prepare a separate memo to the partner briefly listing and discussing the five or six most important factors or risk areas that will likely affect how the audit is conducted if the Ocean engagement is accepted. Be sure to indicate specific ways in which the audit firm should tailor its approach based on the factors you identify.

It is recommended that you read the Professional Judgment Introduction found at the beginning of this book prior to responding to the following questions.

[6] [a] How might the confirmation tendency affect the auditor's client acceptance decision?

[b] How might the overconfidence tendency come into play in the auditor's client acceptance decision?

[c] How might an auditor mitigate the possible effects of the confirmation and overconfidence tendencies in a client acceptance situation?

Step by Step Answer:

Auditing Cases An Interactive Learning Approach

ISBN: 9780134421827

7th Edition

Authors: Mark S Beasley, Frank A. Buckless, Steven M. Glover, Douglas F Prawitt