Custom Furniture Company was ready for an audit by a new CPA firm after replacing the previous

Question:

Custom Furniture Company was ready for an audit by a new CPA firm after replacing the previous auditor who had performed the audit for several years. The lawsuit filed by Custom's creditors against the predecessor auditors was still in court, but the billing clerk and cashier who perpetrated last year's fraud had been replaced by experienced and bonded personnel. Several members of the board of directors had been replaced, and Custom Furniture Company had a new group of officers.

Taught and Tight, CPAs, were hired to be the new auditors after submitting the low bid among a large group of CPA firms. A number of "get acquainted" meetings had been held, and at the present time, relations between Custom Furniture Company and its new auditors seemed to be pleasant.

Tonnie, an experienced audit senior, and Bill, a new staff assistant, were assigned to perform the audit of the financial statements for the year ended December 31, 19X8. Even though it was early in 19X8, Tonnie and Bill were holding meetings to plan the audit. The initial plan was to obtain an understanding of and test Custom's internal control in October 19X8 and then to return in mid-January 19X9 to perform the remaining work.

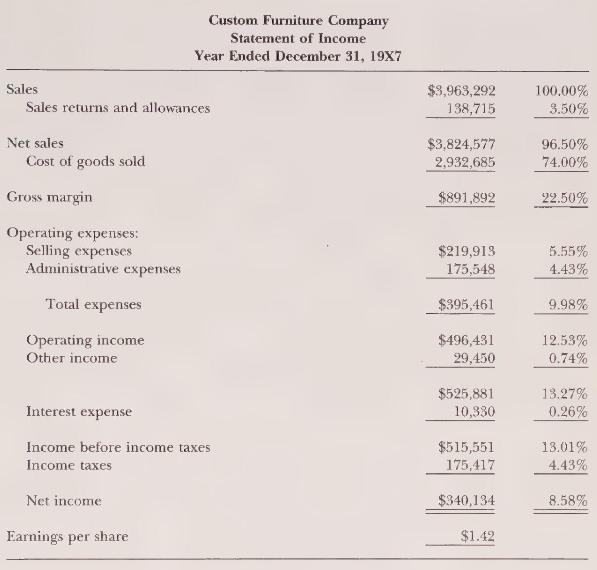

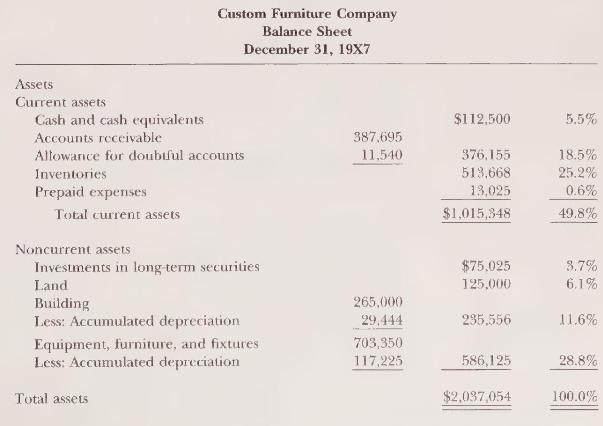

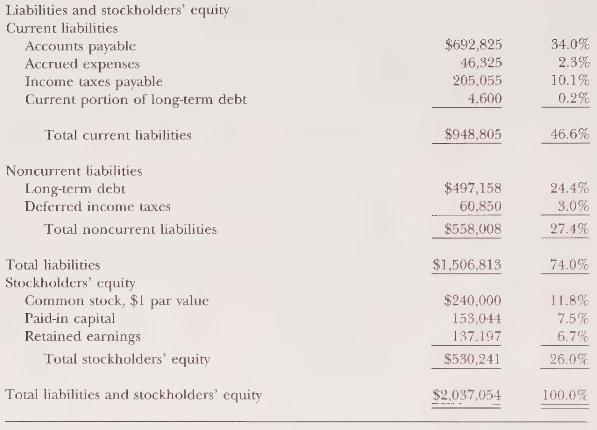

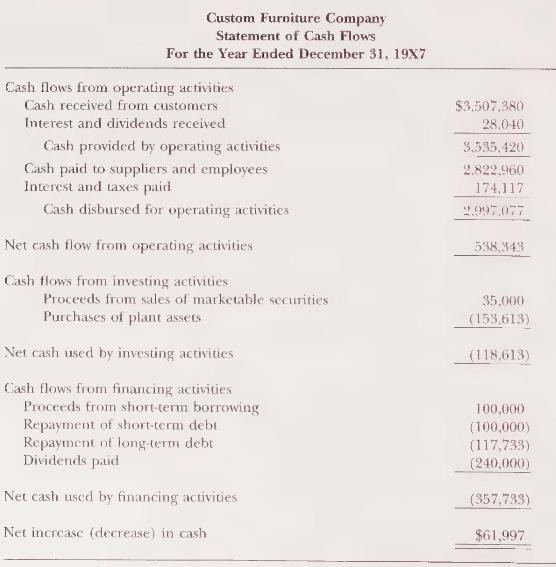

Tonnie and Bill were reviewing Custom's financial statements for the year ended December 31, 19X7, which had been audited by the prior CPA firm and adjusted for the thefts of the billing clerk and cashier. Consultations had been held with the prior CPA firm, and Tonnie and Bill had no reason to believe the 19X7 financial statements were not fairly presented after all adjustments were recorded. Some of the financial statements are shown on the next two pages.

Tonnie and Bill were trying to put together a preliminary audit program that would be altered appropriately when more planning and more work on internal control had been done. They were concentrating on how estimates of materiality and audit risk would affect their audit of individual accounts and assertions.

Subject to later review, they decided to use the "textbook approach" and do the following:

1. Assess an overall materiality to the financial statements based on the factors relevant to this year's audit and the factors that had caused the prior-year auditors so much trouble (the fraud carried out by the billing clerk and the cashier). Also, some of Custom's prior customers had filed lawsuits against Custom for bodily damage when some of Custom's furniture collapsed while in use.

2. Assign a part of the overall materiality to all or most of the financial statement accounts.

3. Assess an overall audit risk to the financial statements and use that percentage as individual audit risks for each assertion within accounts and disclosures.

4. Use the audit risk model to compute detection risk for each assertion.

Required:

Using the 19X7 financial statements on pages 205-206 and other information discussed in previous pages, do the following:

a. Write a memo describing all the factors Tonnie and Bill should consider in deciding on total materiality for the financial statements. Do not decide on an actual amount.

b. Write a memo describing all the factors Tonnie and Bill should consider in deciding how the total materiality should be assigned to the accounts. Do not decide on actual amounts.

c. Write a memo describing all the factors Tonnie and Bill should consider in deciding on the overall audit risk for the financial statements. Do not decide on an actual percentage.

d. Write a memo describing all the factors Tonnie and Bill should consider in assessing and computing the percentages to derive detection risk for each assertion. Do not decide on actual percentages.

Step by Step Answer:

Auditing An Assertions Approach

ISBN: 9780471134213

7th Edition

Authors: G. William Glezen, Donald H. Taylor