In your audit of Ryan Company for the year ended December 31, 19X8, you note that the

Question:

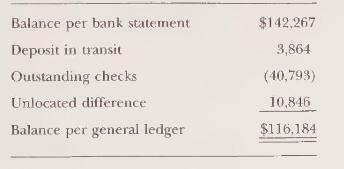

In your audit of Ryan Company for the year ended December 31, 19X8, you note that the bank reconciliation for the Third National Bank Account contains a large unlocated difference, as shown below.

From the bank statements (including the cutoff statement you received directly from the bank) and cash records, you determine the following:

1. A deposit in the amount of \(\$ 3,678\) of Rain Company was credited against the company's account in error in December.

2. A check in payment of an advertising invoice cleared the bank in December in the amount of \(\$ 10,318\) that was recorded in the cash book at \(\$ 2,318\).

3. Unrecorded bank service charges for December amounted to \(\$ 125\).

4. Proceeds of a bank loan on December \(1,19 \mathrm{X} 8\), discounted for three months at 8 percent, had not been recorded by the company in the amount of \(\$ 9,800\).

5. No entry had been made to record the return for NSF of a customer's check of \(\$ 8,798\).

6. A deposit for the collection of accounts receivable was recorded as \(\$ 21,079\), whereas the actual deposit in the bank was \(\$ 13,678\).

7. A check for a salesperson's expenses recorded in the cash disbursement books and shown on the outstanding check list as \(\$ 612\) cleared with the cutoff bank statement and was noted to be in the amount of \(\$ 216\).

8. The company is required by an informal agreement with the bank to maintain a compensating balance of \(\$ 100,000\).

{Required:}

a. State the objectives for the audit of cash.

b. State the procedures you would consider using to accomplish the objectives. (The final determination would depend on your evaluation of internal control, although it appears to be ineffective from some of the items noted above.)

c. Prepare the adjusting entry and footnote disclosures necessary for a fair presentation of cash.

Step by Step Answer:

Auditing An Assertions Approach

ISBN: 9780471134213

7th Edition

Authors: G. William Glezen, Donald H. Taylor