You have been assigned to the audit of a medium-sized manufacturer of machine parts whose fiscal year

Question:

You have been assigned to the audit of a medium-sized manufacturer of machine parts whose fiscal year ends October 31. You and the senior arrive on Monday, November 13, to start the fieldwork for completing the audit. The senior gives you a copy of the accounts receivable aging schedule prepared by the company, the audit program, the control risk evaluation, and a file containing all working papers in connection with confirmation of receivables mailed on November 2. The file contains the following information:

Computer listing of accounts receivable at October 31.

A working paper showing the name, address, and balance of 12 customers to whom positive requests for confirmation were mailed.

Four customers' statements marked across the face "Do not mail."

Five positive requests that have been returned by customers confirming the balances as being correct.

Eight negative confirmations that have been returned with notations made thereon by customers.

Two positive requests and one negative request returned by the post office marked "unknown" or with a similar designation.

The senior introduces you to the credit manager, the accounts receivable bookkeeper, and the billing clerk. She then instructs you to proceed with the tests of the aging schedule and completion of the audit work on accounts receivable, as outlined in the audit program, and advises that she will return the next day to answer any questions you have with respect to the accounts receivable.

The senior informs you that the computer listing of accounts receivable was prepared by the accounts receivable bookkeeper for your use in sending out the confirmations. Your representative checked the customers' statements against the listing and the accounts receivable detail ledger, but did not check the total of the listing. However, you note that the total at the bottom of the listing does agree with the total shown on the aging schedule prepared by the company. You are told that either positive or negative requests were sent to all of the 50 accounts.

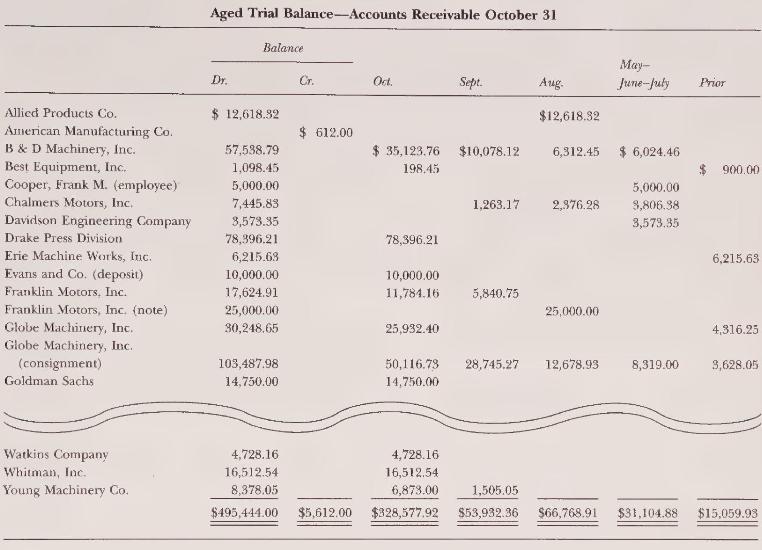

The aging schedule is shown on page 505. You are to assume that internal control is effective. You should study the aging schedule and answer the questions that follow. The normal credit terms are net 30 .

Required:

a. What auditing procedures should the audit program call for with respect to the aging schedule?

b. Which items on the aging schedule would you select for additional auditing procedures, why would you select them, and what procedures would you use?

c. What would you do with the computer listing prepared at the time the confirmations were mailed?

d. What would you do with the statements marked "Do not mail"?

e. Which items would you select for discussion with the senior?

f. What would you do with the five positive requests that were returned indicating no exceptions?

g. In examining these positive requests, what would you look for?

h. What would you do with the requests returned by the post office marked "Unknown" or with a similar designation?

i. What would you do with the negative requests returned with notations made by customers?

j. What is your evaluation of the extent of substantive tests of accounts receivable?

Step by Step Answer:

Auditing An Assertions Approach

ISBN: 9780471134213

7th Edition

Authors: G. William Glezen, Donald H. Taylor