You have been engaged to audit the financial statements of the Elliott Company for the year ended

Question:

You have been engaged to audit the financial statements of the Elliott Company for the year ended December 31, 19X9. You performed a similar audit as of December 31, 19X8.

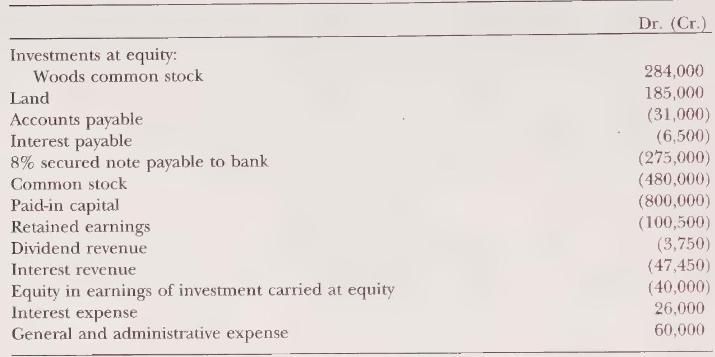

Following is the trial balance for the company as of December 31, 19X9:

You have obtained the following data concerning certain accounts:

The \(6^{1 / 2}\) percent note receivable is due from Tysinger Corporation and is secured by a first mortgage on land sold to Tysinger by Elliott on December 21, 19X8. The note was to have been paid in 20 equal quarterly payments beginning March 31, 19X9, plus interest. Tysinger, however, is in very poor financial condition and has not made any principal or interest payments to date.

The Bowen common stock was purchased on September 21, 19X8, for cash in the market where it is actively traded. It is used as security for the note payable and is held by the bank. Elliott's investment in Bowen represents approximately one percent of the total outstanding shares of Bowen.

Elliott's investment in Woods represents 40 percent of the outstanding common stock; the stock is actively traded. Woods is audited by another CPA and has a December 31 yearend.

Elliott neither purchased nor sold any stock investments during the year other than those noted above.

Required:

For the following account balances, discuss (1) the types of evidential matter you should obtain and (2) the procedures you should perform during your audit.

a. \(6 \frac{1}{2}\) percent secured note receivable.

b. Bowen common stock.

c. Woods common stock.

d. Dividend revenue.

Step by Step Answer:

Auditing An Assertions Approach

ISBN: 9780471134213

7th Edition

Authors: G. William Glezen, Donald H. Taylor