The Castillo Products Company described in Problem 6 had a very difficult operating year in 2018, resulting

Question:

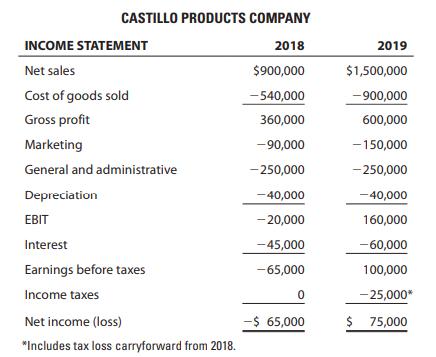

The Castillo Products Company described in Problem 6 had a very difficult operating year in 2018, resulting in a net loss of $65,000 on sales of $900,000. In 2019, sales jumped to $1,500,000, and a net profit after taxes was earned. The firm’s income statements are shown in the following table.

A. Calculate each income statement item for 2018 as a percentage of the 2018 sales level. Make the same calculations for 2019. Determine which cost or expense items varied directly with sales for the two-year period.

B. Use the information in Part A to classify specific expense items as being either variable or fixed expenses. Then estimate Castillo’s EBDAT breakeven in terms of survival revenues if interest expenses had remained at the 2018 level ($45,000) in 2019.

C. Estimate the dollar amount of survival revenues actually needed by the Castillo Products Company to reach EBDAT breakeven in 2019, given that more debt was obtained and interest expenses increased to $60,000.

Step by Step Answer: