Consider data on 3 month market yield on US Treasury securities from January 1983 to December (2012(T=360))

Question:

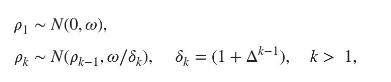

Consider data on 3 month market yield on US Treasury securities from January 1983 to December \(2012(T=360)\) (from wikiposit). Classical estimation (e.g. using the arima routine in \(\mathrm{R}\) ) shows an \(\mathrm{AR}(3)\) model to have significant lags at \(t=1\) and \(t=3\), but not at \(t=2\), while an \(\operatorname{AR}(2)\) model has significant lags at \(t=1\) and \(t=2\). Consider the smoothness prior

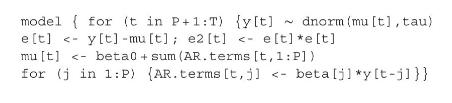

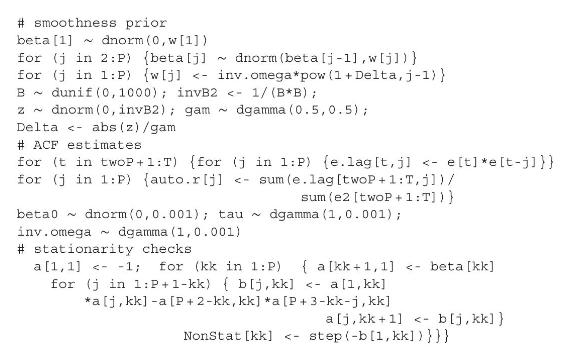

with \(\Delta>0\). The following code applies this scheme, using a half Cauchy prior on \(\Delta\), while checking for non-stationarity (since stationarity is not imposed in the prior). The code also provides empirical estimates of the residual autocorrelation function, which is one aspect of model adequacy.

Thus with \(P=3\), the BUGS code is

Compare estimates from this model to:

(a) a model with stationarity imposed (e.g. using priors on the partial correlations of the \(\operatorname{AR}(p)\) process);

(b) a model where the coefficients \(\delta_{k}>1\) are allowed to vary between lags \(k>1\), subject to \(\delta_{k}>\delta_{k-1}\).

Step by Step Answer: