Borrico Ltd manufacture a single product and they had recently introduced a system of budgeting and variance

Question:

Borrico Ltd manufacture a single product and they had recently introduced a system of budgeting and variance analysis. The following information is available for the month of July 2018:

1

2 Standard costs were:

Direct labour 48,250 hours at £6.50 per hour.

Direct materials 20,000 kilograms at £10 a kilogram.

3 Actual manufacturing costs were:

Direct labour 50,000 hours at £6.75 per hour.

Direct materials 18,900 kilograms at £10.65 a kilogram.

4 Budgeted sales were 20,000 units at £50 a unit.

Actual sales were 15,000 units at £52 a unit 5,200 units at £56 a unit

5 There was no work in progress or inventory of finished goods.

Required:

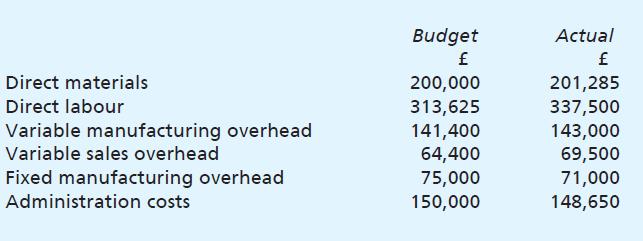

(a) An accounting statement showing the budgeted and actual gross and net profits or losses for July 2018.

(b) The following variances for July 2018.

(i) Direct materials cost variance, direct materials price variance and direct materials usage variance.

(ii) Direct labour cost variance, direct labour rate variance and direct labour efficiency variance.

(c) What use can the management of Borrico Ltd make of the variances calculated in (b) above?

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster