From the following selected balances of Royal Oak plc as at 31 March 2018 draw up (i)

Question:

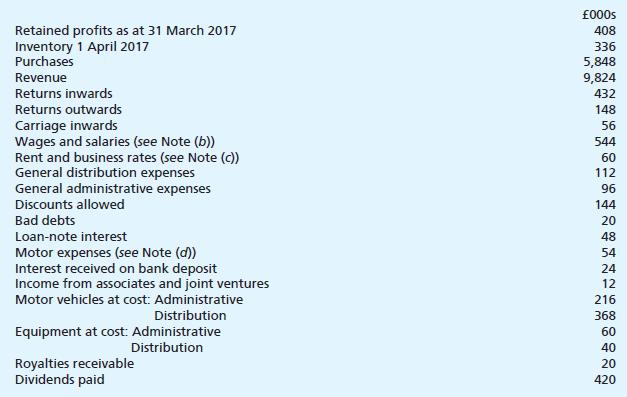

From the following selected balances of Royal Oak plc as at 31 March 2018 draw up (i) a detailed statement of profit or loss for internal use, and (ii) a statement of profit or loss for publication.

(a) Inventory at 31 March 2018 £408,000.

(b) Wages and salaries are to be apportioned: distribution costs 1/4 , administrative expenses 3/4.

(c) Rent and business rates are to be apportioned: distribution costs 60%, administrative expenses

40%.

(d) Apportion motor expenses in the proportions 2:3 between distribution costs and administrative expenses.

(e) Depreciate motor vehicles 25% and equipment 10% on cost.

(f) Accrue auditors’ remuneration of £44,000.

(g) Accrue corporation tax for the year on ordinary activity profits £1,456,000.

(h) A sum of £60,000 is to be transferred to general reserve.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster