Hirwaun Pig Iron Co. operate a single blast furnace producing pig iron. The present blast furnace is

Question:

Hirwaun Pig Iron Co. operate a single blast furnace producing pig iron. The present blast furnace is obsolete and the company is considering its replacement. The alternatives the company is considering are:

(i) Blast furnace type Exco. Cost £2 million. This furnace is of a standard size capable of a monthly output of 10,000 tonnes. The company expects to sell 80 per cent of its output annually at £150 per tonne on a fixed price contract.

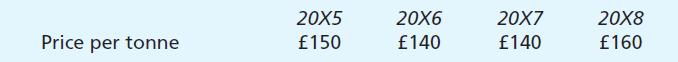

The remaining output will be sold on the open market at the following expected prices:

(ii) Blast furnace type Ohio. Cost £3.5 million.

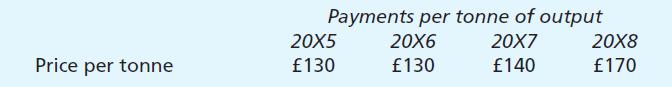

This large furnace is capable of a monthly output of 20,000 tonnes. A single buyer has agreed to buy all the monthly output at a fixed price which is applicable from 1 January each year. The prices fixed for the next four years are as follows:

Additional information:

1. Blast furnaces operate continuously and the operating labour is regarded as a fixed cost. During the next four years the operating labour costs will be as follows:

Exco £1.2 million per annum

Ohio £2.5 million per annum

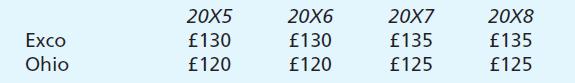

2. Other forecast operating payments (excluding labour) per tonne:

3. It can be assumed that both blast furnaces will have a life of 10 years.

4. The company’s cost of capital is 12 per cent per annum.

5. It should be assumed that all costs are paid and revenues received at the end of each year.

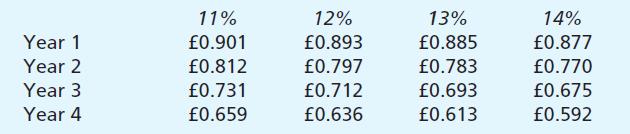

6. The following is an extract from the present value table for £1:

Required:

(a) The forecast budgets for each of the years 20X5–20X8 and for each of the blast furnaces being considered. Show the expected yearly net cash flows.

(b) Appropriate computations using the net present value method for each of the blast furnaces, Exco and Ohio, for the first four years.

(c) A report providing a recommendation to the management of Hirwaun Pig Iron Co. as to which blast furnace should be purchased. Your report should include a critical evaluation of the method used to assess the capital project.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster