Object Limited is a retail outlet selling word processing equipment both for cash and on hire purchase

Question:

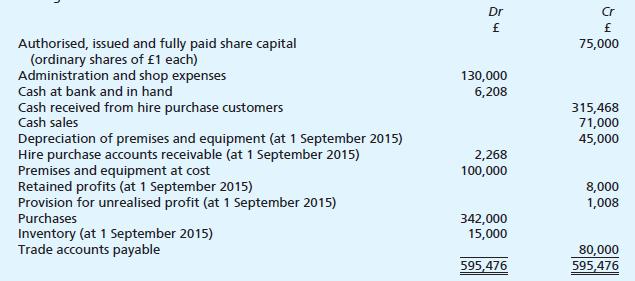

Object Limited is a retail outlet selling word processing equipment both for cash and on hire purchase terms. The following information has been extracted from the books of account as at 31 August 2016:

Additional information:

1 The company’s policy is to take credit for gross profit (including interest) for hire purchase sales in proportion to the instalments collected. It does this by raising a provision against the profit included in hire purchase accounts receivables not yet due.

2 The cash selling price is fixed at 50% and the hire purchase selling price at 80% above the cost of goods purchased.

3 The hire purchase contract requires an initial deposit of 20% of the hire purchase selling price, the balance to be paid in four equal instalments at quarterly intervals. The first instalment is due three months after the agreement is signed.

4 Hire purchase sales for the year amounted to £540,000 (including interest).

5 In February 2016 the company repossessed some goods which had been sold earlier in the year.

These goods had been purchased for £3,000, and the unpaid instalments on them amounted to £3,240. They were then taken back into inventory at a value of £2,500. Later on in the year they were sold on cash terms for £3,500.

6 Depreciation is charged on premises and equipment at a rate of 15% per annum on cost.

Required:

Prepare Object Limited’s statement of profit or loss for the year ending 31 August 2016, and a statement of financial position as at that date.

Your workings should be submitted.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster