Paul Wagtail started a small manufacturing business on 1 May 2015. He has kept his records on

Question:

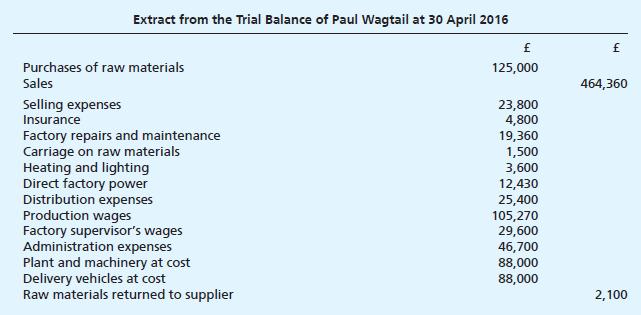

Paul Wagtail started a small manufacturing business on 1 May 2015. He has kept his records on the double entry system, and has drawn up a trial balance at 30 April 2016 before attempting to prepare his first final accounts.

At 30 April 2016, he has closing inventory of raw materials costing £8,900. He has manufactured 9,500 completed units of his product, and sold 8,900. He has a further 625 units that are 80% complete for raw materials and production labour, and also 80% complete for factory indirect costs.

He has decided to divide his insurance costs and his heating and lighting costs 40% for the factory and 60% for the office/showroom.

He wishes to depreciate his plant and machinery at 20% p.a. on cost, and his delivery vehicles using the reducing balance method at 40% p.a.

He has not yet made up his mind how to value his inventories of work in progress and finished goods. He has heard that he could use either marginal or absorption costing to do this, and has received different advice from a friend running a similar business and from an accountant.

Required:

(a) Prepare Paul Wagtail’s manufacturing account and statement of profit or loss for the year ending 30 April 2016 using both marginal and absorption costing methods, preferably in columnar format.

(b) Advise Paul Wagtail of the advantages and disadvantages of using each method.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster