R. Sheldon presents you with the trading account set out above.(Authors note) He always calculates his selling

Question:

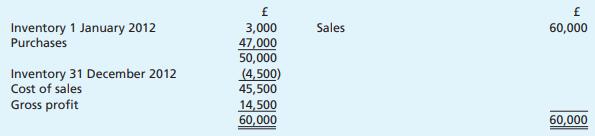

R. Sheldon presents you with the trading account set out above.(Authors’ note) He always calculates his selling price by adding 331 /3% of cost on to the cost price.

(a) If he has adhered strictly to the statement above, what should be the percentage of gross profit to sales?

(b) Calculate his actual percentage of gross profit to sales.

(c) Give two reasons for the difference between the figures you have calculated above.

(d) His suppliers are proposing to increase their prices by 5%, but R. Sheldon considers that he would be unwise to increase his selling price. To obtain some impression of the effect on gross profit if his costs should be increased by 5% he asks you to reconstruct his trading account to show the gross profit if the increase had applied from 1 January 2012.

(e) Using the figures given in the trading account at the beginning of the question, calculate R. Sheldon’s rate of inventory turnover.

(f) R. Sheldon’s expenses amount to 10% of his sales. Calculate his net profit for the year ending 31 December 2012. (g) If all expenses remained unchanged, but suppliers of inventory increased their prices by 5% as in

(d) above, calculate the percentage reduction in the amount of net profit which R. Sheldon’s accounts would have shown.

Step by Step Answer:

Frank Woods Business Accounting

ISBN: 9780273759287

12th Edition

Authors: Frank Wood. Sangster, Alan