Richard Toms has agreed to purchase the business of Norman Soul with effect from 1 August 20X7.

Question:

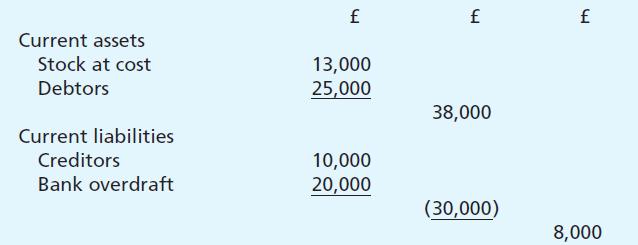

Richard Toms has agreed to purchase the business of Norman Soul with effect from 1 August 20X7. Soul’s budgeted working capital at 1 August 20X7 is as follows:

In addition to paying Soul for the acquisition of the business, Toms intends to improve the liquidity position of the business by introducing £10,000 capital on 1 August 20X7. He has also negotiated a bank overdraft limit of £15,000. It is probable that 10 per cent of Soul’s debtors will in fact be bad debts and that the remaining debtors will settle their accounts during August subject to a cash discount of 10 per cent. The opening creditors are to be paid during August. The sales for the first four months of Toms’ ownership of the business are expected to be as follows: August £24,000, September £30,000, October £30,000 and November £36,000. All sales will be on credit and debtors will receive a two-month credit period. Gross profit will be at a standard rate of 25 per cent of selling price. In addition, in order to further improve the bank position and to reduce his opening stock, Toms intends to sell on 1 August 20X7 at cost price £8,000 of stock for cash. In order to operate within the overdraft limit Toms intends to control stock levels and to organise his purchases to achieve a monthly rate of stock turnover of 3. He will receive one month’s credit from his suppliers. General cash expenses are expected to be £700 per month.

Required:

(a) A stock budget for the four months ending 30 November 20X7 showing clearly the stock held at the end of each month.

(b) A cash budget for the four months ending 30 November 20X7 showing clearly the bank balance at the end of each month.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster