Spectrum Ltd is a private company with an authorised capital of 700,000 divided into shares of 1

Question:

Spectrum Ltd is a private company with an authorised capital of £700,000 divided into shares of £1 each. 500,000 shares have been issued and are fully paid. The company has been formed to acquire small retail shops and establish a chain of outlets. The company made offers to three sole traders and purchased the businesses run by Red, Yellow and Blue. The assets acquired, liabilities taken over, and prices paid are listed below:

The company also purchased a warehouse to be used as a central distribution store for £60,000. This has been paid. Preliminary expenses (formation expenses) of £15,000 have also been paid. The company took over the three shops outlined above and started trading on 1 January 2011.

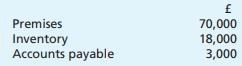

Approaches have also been made to Green for the purchase of his business for £100,000. Green has accepted the offer and the company will take over in the near future the following assets and liabilities:

The transaction had not been completed on 1 January 2011 and Green was still running his own business.

(a) Prepare the opening statement of financial position of Spectrum Ltd as at 1 January 2011.

(b) How would you advise Spectrum Ltd to finance the purchase of Green’s business when the deal is completed?

Step by Step Answer:

Frank Woods Business Accounting

ISBN: 9780273759287

12th Edition

Authors: Frank Wood. Sangster, Alan