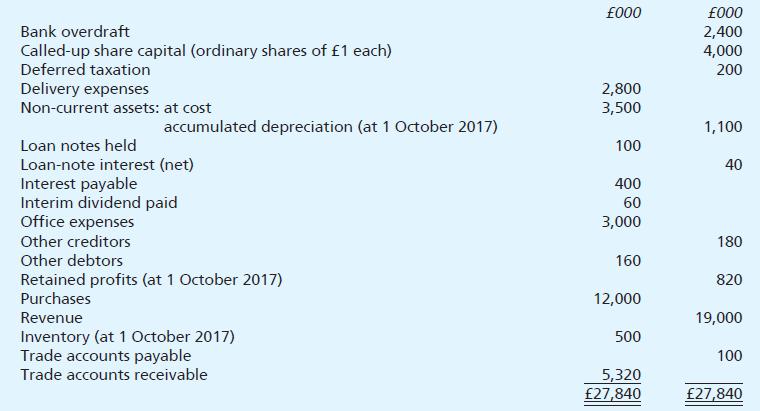

The following information has been extracted from the books of Quire plc as at 30 September 2018.

Question:

The following information has been extracted from the books of Quire plc as at 30 September 2018.

The following additional information is to be taken into account:

1 Inventory at 30 September 2018 was valued at £400,000.

2 All items in the above trial balance are shown net of value added tax.

3 At 30 September 2018, £130,000 was outstanding for office expenses, and £50,000 had been paid in advance for delivery van licences.

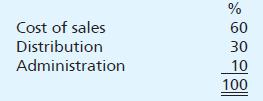

4 Depreciation at a rate of 50% is to be charged on the historic cost of the tangible non-current assets using the reducing balance method: it is to be apportioned as follows:

There were no purchases or sales of non-current assets during the year to 30 September 2018.

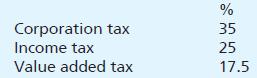

5 The following rates of taxation are to be assumed:

The corporation tax payable based on the profits for the year to 30 September 2018 has been estimated at £80,000.

6 A transfer of £60,000 is to be made from the deferred taxation account.

7 The directors propose to pay a final ordinary dividend of 3p per share.

Required:

In so far as the information permits, prepare Quire plc’s statement of profit or loss for the year ending 30 September 2018, and a statement of financial position as at that date in accordance with the requirements of the relevant accounting standards.

Formal notes to the accounts are NOT required, but detailed workings should be submitted with your answer.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster