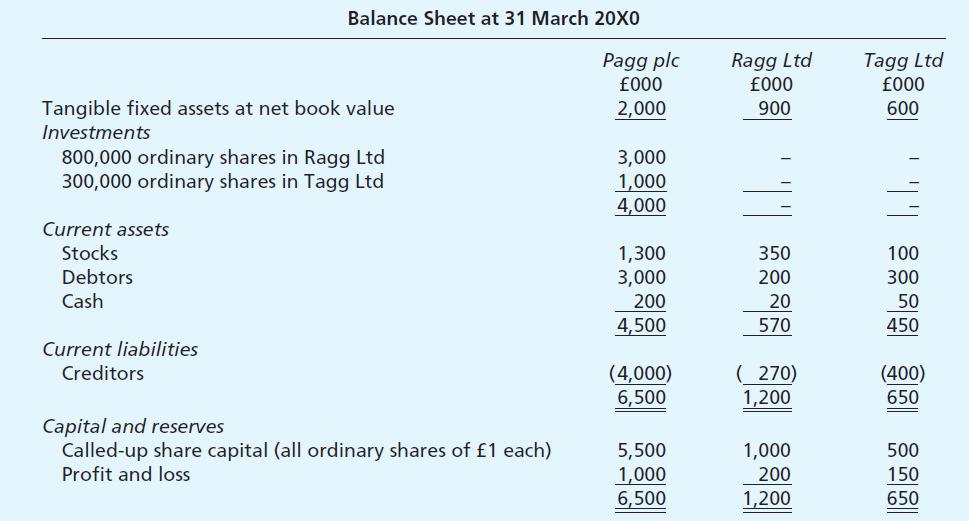

The following summarised information relates to the Pagg group of companies. Additional information: 1. Pagg acquired its

Question:

The following summarised information relates to the Pagg group of companies.

Additional information:

1. Pagg acquired its shareholding in Ragg Ltd on 1 April 20X5. Ragg’s profit and loss account balance at that time was £600,000.

2. The shares in Tagg Ltd were acquired on 1 April 20X9 when Tagg’s profit and loss account balance was £100,000.

3. All goodwill arising on consolidation is amortised in equal amounts over a period of 20 years commencing from the date of acquisition of each subsidiary company.

4. At 31 March 20X0, Ragg had in stock goods purchased from Tagg at a cost to Ragg of £60,000. These goods had been invoiced by Tagg at cost plus 20 per cent. Minority interests are not charged with any intercompany profit.

5. Intercompany debts at 31 March 20X0 were as follows: Pagg owed Ragg £200,000 and Ragg owed Tagg £35,000.

Required:

In so far as the information permits, prepare the Pagg group of companies’ consolidated balance sheet as at 31 March 20X0 in accordance with the Companies Acts and standard accounting practice.

Formal notes to the accounts are NOT required, although detailed working must be submitted with your answer.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster