The Merton Manufacturing Co Ltd has been in business for many years making fitted furniture and chairs.

Question:

The Merton Manufacturing Co Ltd has been in business for many years making fitted furniture and chairs. During 20X4 and 20X5 substantial losses have been sustained on the manufacture of chairs and the directors have decided to concentrate on the fitted furniture side of the business which is expected to produce a profit of at least £22,500 per annum before interest charges and taxation. A capital reduction scheme has been proposed under which:

(i) A new ordinary share of 50p nominal value will be created;

(ii) The £1 ordinary shares will be written off and the shareholders will be offered one new ordinary share for every six old shares held;

(iii) The £1 6 per cent redeemable preference shares will be cancelled and the holders will be offered for every three existing preference shares, one new ordinary share and £1 of a new 8 per cent debenture;

(iv) The existing 11 per cent debenture will be exchanged for a new debenture yielding 8 per cent and in addition existing debenture holders will be offered one new ordinary share for every £4 of the old debenture held;

(v) Existing reserves will be written off;

(vi) Goodwill is to be written off;

(vii) Any remaining balance of write-off which is necessary is to be achieved by writing down plant and equipment; and

(viii) Existing ordinary shareholders will be invited to subscribe for two fully paid new ordinary shares at par for every three old shares held.

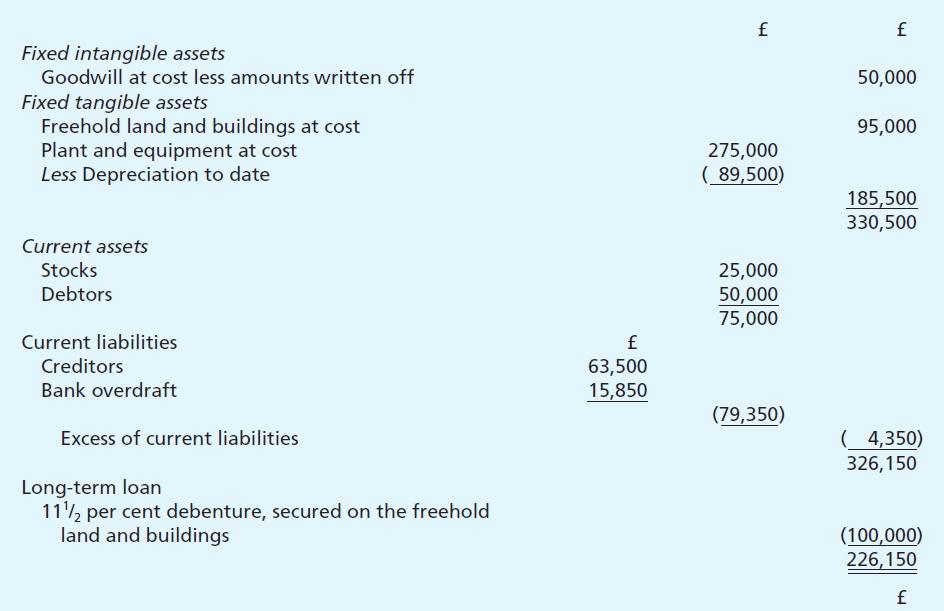

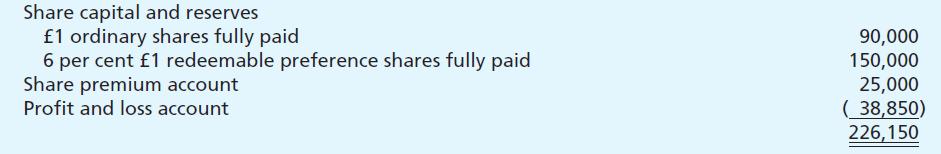

The balance sheet of the Merton Manufacturing Co Ltd immediately prior to the capital reduction is as follows:

On a liquidation, freehold land and buildings are expected to produce £120,000, plant and equipment £40,000, stocks £15,000 and debtors £45,000. Goodwill has no value.

There are no termination costs associated with ceasing the manufacture of chairs.

Required:

(a) Assuming that the necessary approval is obtained and that the new share issue is successful, produce a balance sheet of the company showing the position immediately after the scheme has been put into effect.

(b) Show the effect of the scheme on the expected earnings of the old shareholders.

(c) Indicate the points which a preference shareholder should take into account before voting on the scheme.

Corporation tax may be taken at 331/3 per cent.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster