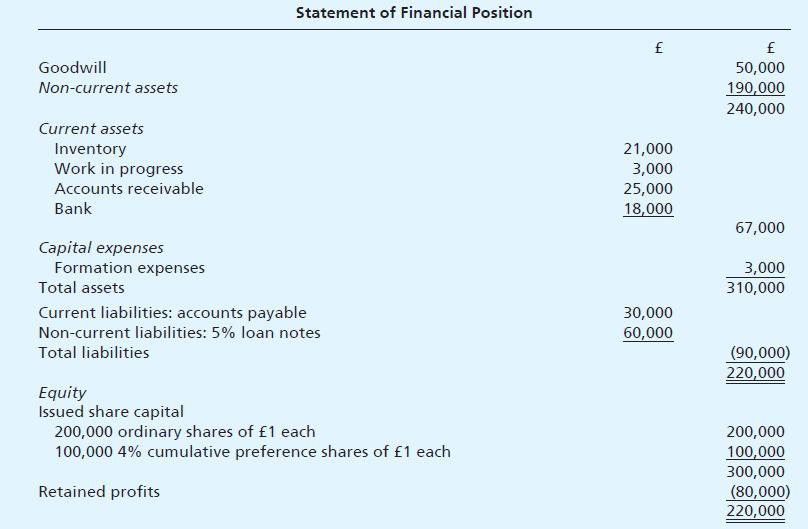

The statement of financial position of Tatters Ltd on 31 December 2015 was as follows: The dividend

Question:

The statement of financial position of Tatters Ltd on 31 December 2015 was as follows:

The dividend on the preference shares is £12,000 in arrears. A scheme of reconstruction was accepted by all parties and was completed on 1 January 2016.

A new company was formed, Rags Ltd, with an authorised share capital of £250,000, consisting of 250,000 ordinary shares of £1 each. This company took over all the assets of Tatters Ltd. The purchase consideration was satisfied partly in cash and partly by the issue, at par, of shares and 6% loan notes by the new company in accordance with the following arrangements:

1 The creditors of the old company received, in settlement of each £10 due to them, £6 in cash and four fully paid ordinary shares in the new company.

2 The holders of preference shares in the old company received nine fully paid ordinary shares in the new company to every ten preference shares in the old company and four fully paid ordinary shares in the new company for every £5 of arrears of dividend.

3 The ordinary shareholders in the old company received one fully paid share in the new company for every four ordinary shares in the old company.

4 The holders of 5% loan notes in the old company received £50 in cash and £50 of 6% loan notes issued at par for every £100 loan notes held in the old company.

5 The balance of the authorised capital of the new company was issued at par for cash and was fully paid on 1 January 2016.

6 Goodwill was eliminated, the inventory was valued at £15,000 and the other current assets were brought into the new company’s books at the amounts at which they appeared in the old company’s statement of financial position. The balance of the purchase consideration represented the agreed value of the non-current assets.

You are required to show:

(a) The closing entries in the realisation account and the sundry shareholders account in the books of Tatters Ltd;

(b) Your calculation of:

(i) The purchase consideration for the assets, and

(ii) The agreed value of the non-current assets;

(c) The summarised statement of financial position of Rags Ltd as on 1 January 2016.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster