A consumer advocacy agency, Equitable Ernest, is interested in providing a service that allows an individual to

Question:

A consumer advocacy agency, Equitable Ernest, is interested in providing a service that allows an individual to estimate their own credit score (a continuous measure used by banks, insurance companies, and other businesses when granting loans, quoting premiums, and issuing credit). The file creditscore contains data from several thousand individuals. The variables in these data are listed in Problem 15.

Predict the individuals’ credit scores using a linear regression model with lasso regularization. Set aside 20% of the data as a test set and use 80% of the data for training and validation.

a. Determine the value of the lasso regularization penalty that minimizes the RMSE in a validation procedure.

b. For the best-performing linear regression model identified in part (a), what is the RMSE on the test set?

c. What are the coefficient values for the variables? Does the lasso regularization remove any variables from the model?

Problem 15

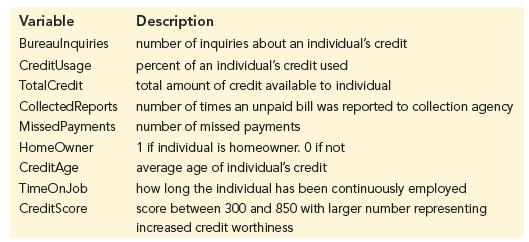

A consumer advocacy agency, Equitable Ernest, is interested in providing a service that allows an individual to estimate their own credit score (a continuous measure used by banks, insurance companies, and other businesses when granting loans, quoting premiums, and issuing credit). The file creditscore contains data from several thousand individuals. The variables in these data are listed in the following table.

Predict the individuals’ credit scores using an individual regression tree. Use 100%

of the data for training and validation and set aside no data as a test set.

Step by Step Answer:

Business Analytics

ISBN: 9780357902219

5th Edition

Authors: Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann