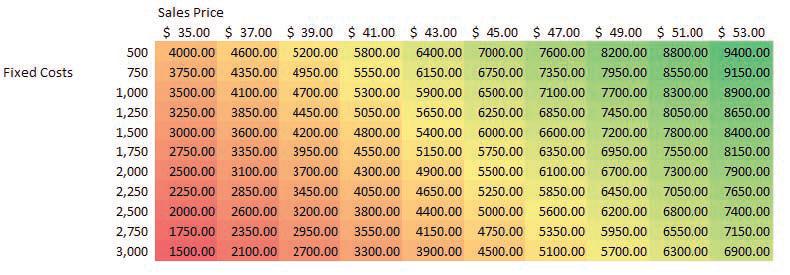

Management accountants can use the following table to perform a sensitivity analysis, evaluating the companys changing profitability

Question:

Management accountants can use the following table to perform a sensitivity analysis, evaluating the company’s changing profitability based on two important inputs: (1) the level of total fixed costs and (2) the sales price of the product. Note that the analysis varies the sales price from $35 to $53 (as shown in the columns) and the fixed costs from $500 to $3,000 (as shown in the rows). Total sales are constant at 300 units and the variable costs are constant at $20 per unit. The colored columns are the total profits based on the changing input parameters.

Required

a. As sales price increases, what happens to the estimated profitability?

b. As total fixed costs increase, what happens to the estimated profitability?

c. If the sales price is $53 and total fixed costs are $3,000, what is the estimated profitability?

d. If the sales price is $45 and total fixed costs are $500, what is the estimated profitability?

Step by Step Answer:

Introduction To Business Analytics

ISBN: 9781265454340

1st Edition

Authors: Vernon Richardson, Marcia Watson