The Galleon case is the largest investigation in history into insider trading within hedge funds. Twenty-six people

Question:

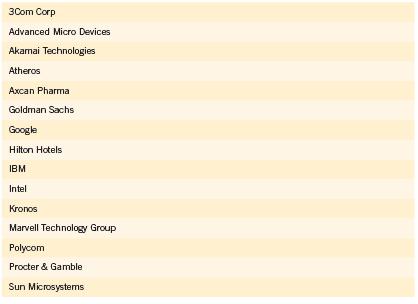

The Galleon case is the largest investigation in history into insider trading within hedge funds. Twenty-six people were charged with fraud and conspiracy. Galleon closed in 2009 after investors quickly withdrew over $4 billion in investments from the company. In addition, over a dozen companies’ stocks were traded based on allegedly nonpublic information

(see Table 2). These trades could have affected the financial status of the companies, their stock prices, and their shareholders.

The Galleon insider trading investigation was the first to use wiretaps, which are normally only used to convict people of involvement in terrorism, drugs, and organized crime. This set a precedent for insider trading cases, and many suspect this method may be used more frequently in the future. Because investment firms rely on email, phone calls, and other digital information, electronic surveillance will likely become the technique of choice for white-collar crime investigators. Federal authorities also hope the Galleon convictions will deter other powerful investment managers from engaging in insider trading.

Manhattan U.S. Attorney Preet Bharara said, “Unlawful insider trading should be offensive to everyone who believes in, and relies on, the market. It cheats the ordinary investor. ... We will continue to pursue and prosecute those who believe they are both above the law and too smart to get caught.”

Questions:-

1. Are information-gathering techniques like Rajaratnam’s common on Wall Street? If so, what could regulators, investors, and executives do to reduce the practice?

2. What are the implications of sharing confidential material information? Is it something that would affect your decision about how to trade a stock if you knew about it?

3. Do you think the secret investigation and conviction of Rajaratnam and other people in the Galleon network will deter other fund managers and investors from sharing nonpublic information?

Step by Step Answer:

Business Ethics Ethical Decision Making And Cases

ISBN: 9781337614436

12th Edition

Authors: O. C. Ferrell, John Fraedrich, Linda Ferrell