Dofasco Inc. was founded in 1912 in Hamilton, Ontario, by Clifton W. Sherman. Dofasco provides steel to

Question:

Dofasco Inc. was founded in 1912 in Hamilton, Ontario, by Clifton W. Sherman. Dofasco provides steel to various industries, including the automotive and pipe industries, and today is considered one of Canada’s leading steel makers. Originally, its strategy was based on producing as much steel as it could in order to be able to grow as much and as fast as possible. Financially, Dofasco was doing very well. However, in the late 1980s, things took an unexpected turn and Dofasco was left in a difficult position. The demand for steel was decreasing, competition was getting fiercer, and costs (operational and capital) were continuously increasing, negatively affecting Dofasco’s sales and profitability. Between 1990 and 1992, Dofasco reported a total net loss of $900 million. The executives of the company understood that it had to take charge and restructure its operations if it were to survive this financial crisis. Dofasco’s first order of business in restructuring the company was to sell off some of its assets, which included many of its divisions. It then went even further and cut its labour force from 13,000 to 7,000 employees. The final step that Dofasco took in its restructuring process was to enter into joint ventures, allowing it to work with companies from different countries. These actions allowed Dofasco to begin its slow climb to the top once again. Dofasco realized that it was extremely important during the restructuring process to focus on its core: its employees. Dofasco made it its mission to engage the employees by recognizing their needs and opinions. This change in organizational setting and human resources represented a significant shift of strategy. Human capital was now becoming Dofasco’s most valuable resource, hence opening the road to financial recovery. Dofasco realized that its workforce was hard-working and motivated and ready to take on challenging work. Dofasco therefore accommodated these needs and provided employees with resources and encouragement to have a more hands-on approach with their customers. The new responsibilities gave employees the ability to get involved in everyday decisions and allowed them to work in teams and cross-functional groups, providing them with a broader view of the overall company process. This made the employees an integral part of the company and made them understand that they were vital to the success of the business. Dofasco believed that empowering employees was one effective way of improving the company, but it also realized that the employees needed to be healthy and safe in order to be more productive. Therefore, in its restructuring process, Dofasco also began health initiatives such as offering information sessions on how to sleep better, weekly Weight Watchers meetings, CPR and first aid demonstrations, yoga and workout sessions, and sessions on how to deal with stress. After its restructuring program in the early 1990s, Dofasco made major strides and successfully managed to overcome its financial crisis. The results of fiscal year 2000 showed the degree of success of the change in business strategy, as sales and net profit reached $3.2 billion and $188 million, respectively. Dofasco now operates as a subsidiary of Luxembourg-based ArcelorMittal, the world’s largest steel producer by volume. In 2012, ArcelorMittal had worldwide sales of more than $84.2 billion.

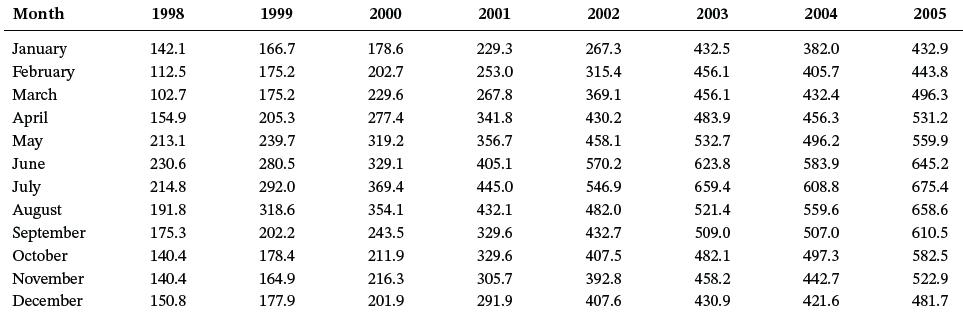

Discussion1. Dofasco realized that the most effective way to improve its business and increase its sales was through a restructuring process. After this process was implemented, Dofasco’s productivity and sales figures began to improve, allowing the company to overcome the financial crisis that it was facing. Dofasco’s impressive sales figures from January 1998 to December 2005 (in billions) are reported below. When analyzing these figures, are any trends apparent? Are there any signs that indicate that Dofasco’s sales may be seasonally influenced? Use the sales figures to perform a decomposition analysis using 12-month seasonality. Following this analysis, determine the trend line and a graphical display using Excel. Take a close look at all this information and put together a brief analysis of Dofasco’s sales. In this analysis, focus on any specific direction that Dofasco’s sales may have been heading toward before its takeover by ArcelorMittal.

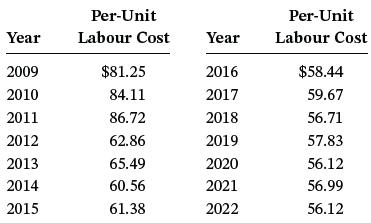

2. It is very important to be able to analyze the cost of steel on a per unit basis. Assume that the company’s financial team was able to calculate this cost for each year between 2009 and 2022. The result of these calculations is shown here. By using information learned in this chapter, such as smoothing techniques, moving averages, and trend analysis, forecast the per-unit labour costs for each year. How would you compute the error of the forecasts and determine which forecasting method is the most effective in reducing error?

2. It is very important to be able to analyze the cost of steel on a per unit basis. Assume that the company’s financial team was able to calculate this cost for each year between 2009 and 2022. The result of these calculations is shown here. By using information learned in this chapter, such as smoothing techniques, moving averages, and trend analysis, forecast the per-unit labour costs for each year. How would you compute the error of the forecasts and determine which forecasting method is the most effective in reducing error?

Step by Step Answer:

Business Statistics For Contemporary Decision Making

ISBN: 9781119577621

3rd Canadian Edition

Authors: Ken Black, Ignacio Castillo