The Skodel Ltd credit manager knows from past experience that if the company accepts a good risk

Question:

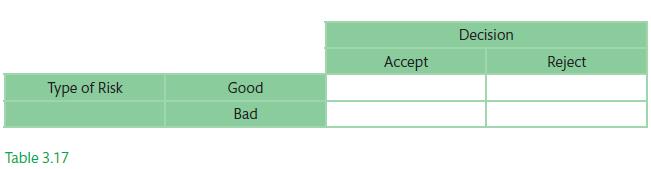

The Skodel Ltd credit manager knows from past experience that if the company accepts a ‘good risk’ applicant for a £60,000 loan the profit will be £15,000. If it accepts a ‘bad risk’ applicant it will lose £6000. If it rejects a ‘bad risk’ applicant nothing is gained or lost. If it rejects a ‘good risk’ applicant it will lose £3000 in good will.

(a) Complete the profit and loss table for this situation.

(b) The credit manager assesses the probability that a particular applicant is a ‘good risk’ is 1/3 and a ‘bad risk’ is 2/3. What would be the expected profits for each of the two decisions? Consequently, what decision should be taken for the applicant?

(c) Another manager independently assesses the same applicant to be four times as likely to be a bad risk as a good one. What should this manager decide?

(d) Let the probability of being a good risk be x. What value of x would make the company indifferent between accepting or rejecting an applicant for a mortgage?

Step by Step Answer: