The report ?Consumer Revolving Credit and Debt Over the Life Cycle and Business Cycle? describes a study

Question:

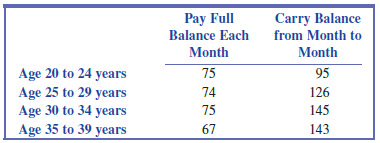

The report ?Consumer Revolving Credit and Debt Over the Life Cycle and Business Cycle? describes a study conducted by the Federal Reserve Bank of Boston (bostonfed.org, October 2015, retrieved May 27, 2017). Data consistent with summary values given in the report are summarized in the accompanying table. Suppose that these data resulted from a random sample of 800 adult Americans age 20 to 39 years old who have at least one credit card. Each person in the sample was classified according to age (with possible categories of 20 to 24 years, 25 to 29 years, 30 to 34 years, and 35 to 39 years). The people in the sample were also classified according to whether or not they pay the full balance on their credit cards each month or sometimes carry over a balance from month to month.

a. To investigate if whether or not people pay their balance in full each month is related to age, which chi-square test (homogeneity or independence) would be the appropriate test? Explain your choice.

b. Carry out an appropriate test to determine if these data provide convincing evidence that whether or not people pay their balance in full each month is related to age.

c. To what population would it be reasonable to generalize the conclusion from the test in Part (b)?

Step by Step Answer:

Introduction To Statistics And Data Analysis

ISBN: 9781337793612

6th Edition

Authors: Roxy Peck, Chris Olsen, Tom Short