Cambridge Accounting provides accounting services to its clients. After several significant server failures, the company is thinking

Question:

Cambridge Accounting provides accounting services to its clients. After several significant server failures, the company is thinking of outsourcing all its data processing requirements to Seven Oaks Data Stream.

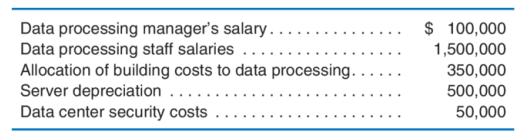

An analysis of current operations suggests that for every dollar increase in service revenues, variable data processing costs increase by $0.10. Fixed costs for the data processing facility are $2.5 million. An analysis of these fixed costs revealed the following distribution:

If the data processing center were closed, the data processing manager would be transferred to another managerial position in the organization. That position is currently open, pays a salary of $90,000, and needs to be filled. All data processing staff would be transferred to other positions in the organization at their current salary. The existing servers would be sold to yield a net value, after disposal costs, of zero. The data center security costs would be eliminated if the data processing center is closed.

Seven Oaks Data Stream has offered to handle all Cambridge Accounting’s data processing requirements at a fee that amounts to $0.08 per dollar of Cambridge Accounting’s service revenue plus $250,000 per year.

Required

(a) Assuming that Seven Oaks Data Stream will provide a service similar to the current in-house service, under what conditions should the offer be accepted?

(b) The managing partner at Cambridge Accounting believes that the quality and reliability of the service provided by Seven Oaks Data Stream surpasses those currently provided in house and would increase revenues by $300,000 per year. Assuming that

(1) Current capacity could handle this additional business

(2) The current sales level is $4,000,000

(3) There are no other variable costs other than those associated with data processing, how would this information be factored into your analysis in part (a)?

Step by Step Answer:

Management Accounting Information For Decision Making

ISBN: 9781618533517

7th Edition

Authors: Anthony A. Atkinson