Alex, Brook, and Charlene each began their own sole proprietorship in a GST province on January 1,

Question:

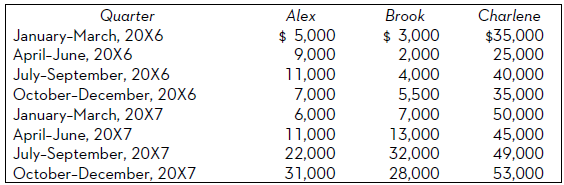

Alex, Brook, and Charlene each began their own sole proprietorship in a GST province on January 1, 20X4. The following chart summarizes their revenue for the first two years of activity:

Additional information:

? Alex sold a piece of capital property on May 15, 20X6 for $8,000.

? Brook always invoices his work on the 28th day of the month. His sales for each quarter were earned equally over each month of the quarter.

? Charlene is a licensed optometrist; 60% of her revenue consists of eye exams, while the remaining 40% consists of sales of eyeglasses and contact lenses.

Required:

For each individual, determine when small supplier status is lost, the date on which they are each required to be registered for GST, and the date on which each individual should begin charging GST.

Alex Brook Charlene Quarter January-March, 20X6 April-June, 20X6 July-September, 20X6 October-December, 20X6 January-March, 20X7 April-June, 20X7 July-September, 20X7 October-December, 20X7 $ 3,000 2,000 $ 5,000 9,000 11,000 7,000 6,000 000,וו $35,000 25,000 40,000 35,000 50,000 45,000 49,000 53,000 4,000 5,500 7,000 13,000 32,000 28,000 22,000 31,000

Step by Step Answer:

Alex Sales of capital property are not included in determining whether the small supplier threshold of 30000 has been surpassed As a result the sales for the April to June 20X6 quarter should be reduc...View the full answer

Canadian Income Taxation 2018-2019

ISBN: 9781259464294

21st Edition

Authors: William Buckwold, Joan Kitunen

Students also viewed these Business questions

-

1. Natasha is an example of what kind of an investor? 2. At each funding stage prior to the IPO (i.e., 1985, 2000, 2003, and 2006) calculate the pre-money and post-money valuation of the equity of...

-

Mr. and Mrs. P own a sole proprietorship that generates approximately $60,000 annual net profit. This business is the couple's only source of income. In April, June, and September, they paid their...

-

In early 2013, Doc and Lyn McGee formed the McGee Cake Company. The company produced a full line of cakes, and its specialties included chess cake,* lemon pound cake, and double-iced,...

-

Hybrid Corporation began operations in 2018 and during that year purchased equity investments. It owns less than 20% of the voting shares for all companies whose stock it purchased. The year-end cost...

-

Explain the branch probabilities listed on this tree diagram, which models the outcomes of selecting two different students from a class of 7 juniors and 14 sophomores. 20 21 3 14 7 20 10 -or- 21 3...

-

The following trading account for the year ended 31 December 20X8 is given to you by M Pole: Pole says that normally he adds 20% to the cost of goods to fix the sales price. However, this year saw...

-

Zachary and Carrie Sexton (the Buyers) were searching for a home in the Kings wood neighborhood of Atlanta, Georgia. The Buyers real estate agent learned that Russell and Linda Sewell (the Sellers)...

-

During Heaton Companys first two years of operations, the company reported absorption costing net operating income as follows: The companys $18 unit product cost is computed as follows: Forty percent...

-

Kevin made two investments over the past two years. His first investment wasabaseball card thatcost$50.00,whichhe sold three months later for$55.00.The second wasashare of stockinastart-upcompany....

-

Consider a thick biconvex lens whose magnitudes of the radii of curvature of the first and second surfaces are 45 cm and 30 cm respectively. The thickness of the lens is 5 cm and the refractive index...

-

Who is required to register for GST/HST?

-

Explain the flow-through nature of the GST/HST system.

-

In Exercises 7376, determine whether the statement is true or false. If it is false, explain why or give an example that shows it is false. d dt [r]=r'()|

-

The team has been working hard throughput the sprint, but time is running out. It's Wednesday, the sprint review is scheduled for Friday, and it looks like the team won't be able to finish everything...

-

Feil Ltd started 2023 with $77,000 of merchandise on hand. During 2023, $395,000 in merchandise was purchased on account with credit terms of 1/10, n/30. All discounts were taken. Purchases were all...

-

In the DAD framework, the Production Ready milestone demonstrates that the solution has met the stakeholders' conditions of acceptance, while the Stakeholder Delight milestone check to determine if...

-

What is the indirect cost of this list? Stainless steel sheet metal $ 6,523 Rubber caps 3,284 President's salary 4,752 Shipping to customers 1,154 Wages for maintenance crew 2,865 Insulation for...

-

On January 1, Padma entered into a contract with Nolan to build a barn. Padma is guaranteed to receive $5,000 in addition to a bonus depending on when the project is completed. Nolan is offering to...

-

In a study of brand recognition of Sony, groups of four consumers are Not Sure 0.30 interviewed. If x is the number of people in the group who recognize the Sony brand name, then x can be 0, 1, 2, 3,...

-

Suppose the index goes to 18 percent in year 5. What is the effective cost of the unrestricted ARM?

-

If a corporation is subject to a 27% tax rate, why may it be advantageous for it to issue debt as opposed to preferred shares?

-

A Ltd. and B Ltd. are partners in the Triple M partnership. A Ltd. and B Ltd. share equally in the income or loss of the partnership annually. The partnership earns business income of $100,000 and...

-

What is a holding corporation?

-

I. For each of the following functions, do the following: a. Determine if f is continuous at a. b. Determine if f is differentiable at a. 1. 5-6x if x3 f(x)=-4-x ifx>3 ; a=3 4. f(x)= x-9 if x <3 ;a=3...

-

Molander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month's budget appear below: Selling price per unit Variable expense per unit Fixed expense per...

-

Consider the simplest complex constellations of 8-PSK and 16-PSK which sends symbols along both the I and Q components, as shown in Fig. 1. Let E denote the average transmit power, and 2 the variance...

Study smarter with the SolutionInn App