DuPont reported depreciation expense of $1,308 million on its consolidated financial statements for the period ended December

Question:

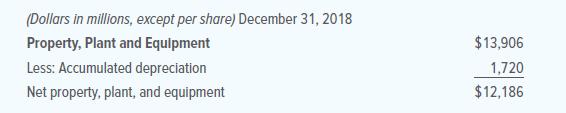

DuPont reported depreciation expense of $1,308 million on its consolidated financial statements for the period ended December 31, 2018. The following excerpt is taken from the company’s consolidated balance sheet for the same year:

Analyze:

1. What percentage of the original cost of property, plant, and equipment was depreciated during 2018?

2. What percentage of property, plant, and equipment cost was depreciated as of December 31, 2018?

3. If the company continued to record depreciation expense at this level each year, how many years remain until all assets would be fully depreciated? (Assume no salvage values.)

Analyze Online: Connect to the DuPont website (www.dupont.com). Click on the Investors link to find information on quarterly earnings.

4. What is the most recent quarterly earnings statement presented? What period does the statement cover?

5. For the most recent quarter, what depreciation expense was reported?

Step by Step Answer:

College Accounting A Contemporary Approach

ISBN: 9781260780352

5th Edition

Authors: David Haddock, John Price, Michael Farina