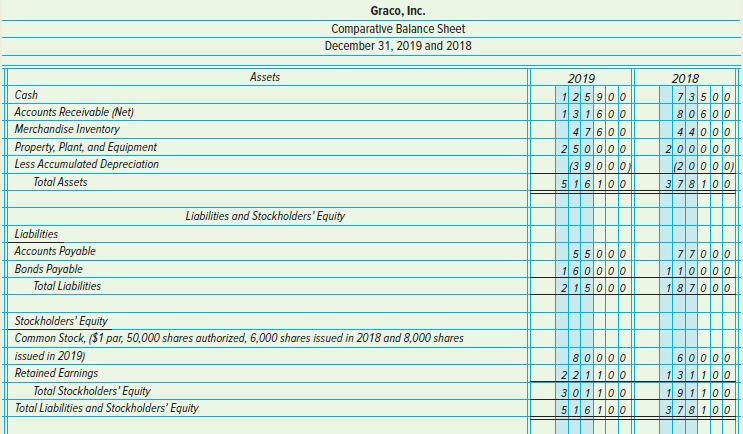

A comparative balance sheet for Graco, Inc., on December 31, 2019 and 2018, follows. Additional information about

Question:

INSTRUCTIONS

Prepare a statement of cash flows for 2019. Additional information for the year follows:

a. Had net income of $90,000.

b. Recorded $19,000 in depreciation.

c. Issued bonds payable with a par value of $50,000 at par and received cash.

d. Received $20,000 in cash for the issue of an additional 20,000 shares of $1 par value common stock.

e. Purchased equipment for $50,000 in cash.

Analyze: Explain why an increase in accounts payable is considered an adjustment to cash flows from operating activities.

Par ValuePar value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina

Question Posted: