In preparing for next year, Tony Freedman has hired two employees to work on an hourly basis

Question:

In preparing for next year, Tony Freedman has hired two employees to work on an hourly basis assisting with some troubleshooting and repair work. (Excel templates for this Continuing Problem are available on MyAccountingLab.)

Assume the following details:

a. The following accounts have been added to the chart of accounts: Wages Expense, 5110; Income Taxes Payable, 2020; CPP Payable, 2030; EI Payable, 2040; and Wages Payable, 2010.

b. CPP is deducted at 4.95% (considering $3,500 yearly exemption).

c. EI is deducted at 1.88% of gross earnings.

d. Both employees pay income taxes at a rate of 20%.

e. Each employee earns $20 an hour and is paid time-and-a-half for hours worked in excess of 40 weekly.

Assignment

1. Record the partial transactions listed below in the appropriate journal and post to the general ledger.

2. Prepare a payroll register.

3. Prepare a trial balance as of November 30, 2019

Nov. 1 Billed Vita Needle Company $6,800, invoice No. 12686, for services rendered.

4 Billed Accu Pac, Inc. $3,900, invoice No. 12687, for services rendered.

5 Purchased new shop benches, $1,400 on account from System Design Furniture (invoice No. 8771) (purchase order No. 4013).

8 Paid the two employees’ wages: Lance Klumm, 38 hours, and Aurelle Hall, 42 hours (cheques No. 258 and No. 259).

11 Received the phone bill, $150.

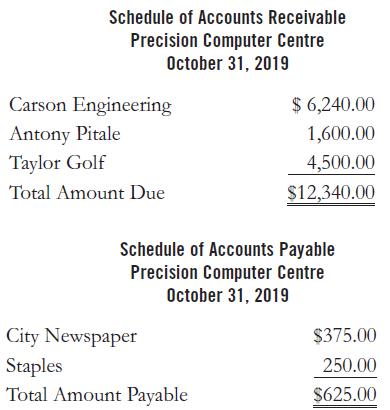

12 Collected $500 of the amount due from Taylor Golf.

15 Paid the two employees’ wages: Lance Klumm, 34 hours, and Aurelle Hall, 36 hours (cheques No. 260 and No. 261).

18 Collected $800 of the amount due from Taylor Golf.

19 Purchased a fax machine for the office from Multi Systems Inc. on credit, $450 (invoice No. 1784) (purchase order No. 4014).

22 Paid the two employees’ wages: Lance Klumm, 32 hours and Aurelle Hall, 35 hours (cheques No. 262 and No. 263).

25 Collected half of the amount due from Vita Needle Company re Nov. 1 transaction.

29 Paid the two employees wages: Lance Klumm, 38 hours, and Aurelle Hall, 44 hours (cheques No. 264 and No. 265).

29 Rent expired for October and November, $800.

Step by Step Answer:

College Accounting A Practical Approach

ISBN: 978-0134166698

13th Canadian edition

Authors: Jeffrey Slater, Debra Good