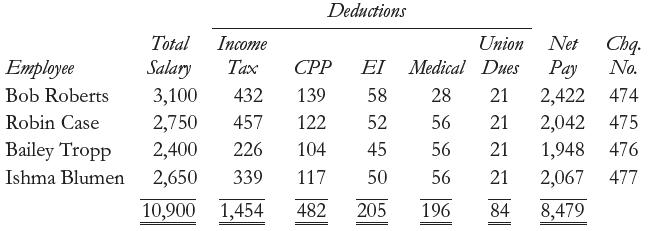

The payroll register for Rice Company of Sackville is summarized below for the month of April, 2018.

Question:

The payroll register for Rice Company of Sackville is summarized below for the month of April, 2018.

The union dues are remitted to the treasurer of the union by the 10th day of the next month. Rice Company matches its employees’ contributions to the medical plan. Assume that the information in the above table has been recorded and cheques No. 474 to 477 were issued.

Required

a. Record the company’s benefits expense, assuming no such entry was made when cheques No. 474 to No. 477 were recorded.

b. In May, the Rice Company issued the following three cheques:

1. May 10, 2018, to the Employees’ Union, cheque No. 495.

2. May 15, 2018, to the CRA, cheque No. 502.

3. May 20, 2018, to the Provincial Health Care Insurance Company, cheque No. 531. How much was each cheque for?

c. What journal entries would be made to record the three cheques in b. above?

Step by Step Answer:

College Accounting A Practical Approach

ISBN: 978-0134166698

13th Canadian edition

Authors: Jeffrey Slater, Debra Good