Wilson Chan has just taken over a business started by his aunt in Sarnia, Ontario, and moved

Question:

Wilson Chan has just taken over a business started by his aunt in Sarnia, Ontario, and moved the company to Regina, Saskatchewan. The company is called Chan’s Imported Technology (CIT for short) and has all new customers in the Regina region. CIT specializes in the sale of three types of advanced electronic devices: cell phones (CP), tablet computers (TC), and portable music players (MP). Wilson wants his bookkeeper to record all sales into the Sales account. CIT’s normal terms are 2/10, n/20, but a couple of customers have been granted special terms of 3/15, n/45. Here are the sales and sales-related transactions for CIT during its first month of operations in August 2019: All inventory sold has a cost of goods sold amount equal to 75% of the sale (if $4,000 of product was sold, the cost of goods sold for that sale would be $3,000).

2019 Aug.

2 Sold $4,000 (CP) and $5,500 (TC) to JIW Enterprises. Invoice No. 2001. Normal terms.

4 Sold $3,200 (CP), $1,600 (TC). and $2,600 (MP) to Case-5 Electronics. Invoice No. 2002. Special terms.

5 Sold $2,900 (TC) and $1,200 (MP) to Advanced Technologies in Motion. Invoice No. 2003. Normal terms.

6 JIW Enterprises messaged that there was a minor problem with the screens of two of the cell phones they purchased on August 2. Wilson agreed to a credit allowance of $150 and issued credit memorandum No. 101 dated this date. Wilson did not take back the inventory.

10 Sold $3,000 (CP), $4,750 (TC), and $1,700 (MP) to Manfred Communications. Invoice No. 2004. Normal terms.

13 Sold $1,400 (CP), $3,500 (TC), and $850 (MP) to JIW Enterprises. Invoice No. 2005. Normal terms.

17 Sold $930 (CP), $1,400 (TC), and $1,100 (MP) to Advanced Technologies in Motion. Invoice No. 2006. Normal terms.

Aug.

20 The purchasing manager for Manfred Communications dropped by to mention that there was a memory flaw in one of the portable music players sold to them on August 10. Manfred had already replaced the memory component with its own supply, and so an adjustment in price of $75 was agreed to. Issued credit memorandum No. 102 to Manfred Communications this date. No inventory was returned.

22 Sold $4,200 (CP), $3,800 (TC), and $1,300 (MP) to WMJ Sales. Invoice No. 2007. Special terms.

26 Sold $6,200 (TC) to Case-5 Electronics. Invoice No. 2008. Special terms.

28 Sold $2,550 (CP), $4,400 (TC), and $1,780 (MP) to Manfred Communications. Invoice No. 2009. Normal terms.

30 Sold $1,430 (CP), $2,800 (TC), and $1,300 (MP) to Advanced Technologies in Motion. Invoice No. 2010. Normal terms.

Required

a. Enter the above transactions in a sales journal and the general journal.

b. Record all transactions to the customers’ accounts in the accounts receivable subsidiary ledger.

c. Prepare a schedule of accounts receivable as of August 31. Please note—if you are also required to complete problem P6-4A (see following), then you should prepare this schedule only once, after all cash receipts have been recorded.

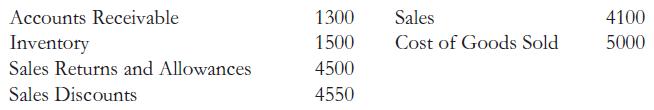

Here are the general ledger account numbers used by CIT:

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

College Accounting A Practical Approach

ISBN: 978-0134166698

13th Canadian edition

Authors: Jeffrey Slater, Debra Good