Streep Company (a U.S.-based company) has branches in three countries: X, Y, and Z. All three branches

Question:

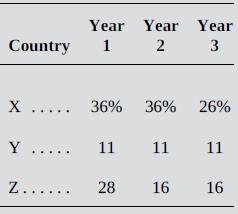

Streep Company (a U.S.-based company) has branches in three countries: X, Y, and Z. All three branches sell goods and services in their host country. Income tax rates on branch profits in these three countries over the most recent three-year period are as follows:

None of these countries imposes a withholding tax on branch profits distributed to a foreign parent company. The U.S. corporate income tax rate over this three-year period was 21 percent.

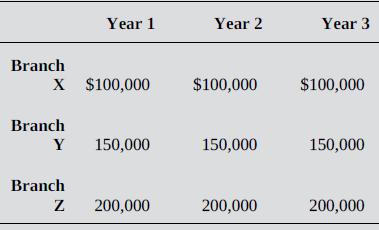

Pretax income earned by each branch over the most recent three-year period is as follows:

Required:

a. Determine the amount of foreign source income Streep will include in its U.S. tax return in each of the three years.

b. Determine the amount of foreign tax credit Streep will be allowed to take in determining its U.S. tax liability in each of the three years.

c. Determine the amount of excess foreign tax credit, if any, Streep will have in each of the three years.

d. Determine Streep’s net U.S. tax liability in each of the three years.

Step by Step Answer:

International Accounting

ISBN: 978-1260466539

5th edition

Authors: Timothy Doupnik, Mark Finn, Giorgio Gotti, Hector Perera