Ocean View Flowers is in the wholesale distribution and sales industry and is located at 100 Ocean

Question:

Ocean View Flowers is in the wholesale distribution and sales industry and is located at 100 Ocean Ave. in Lompoc, CA 93436. Ocean View started business as a corporation on January 1, 2016, and owner Scott Cruz would like you to use QuickBooks Accountant to keep track of its business transactions. Ocean View is a calendar year corporation (for both fiscal and tax purposes) and will need to use the inventory, purchase order, and manual payroll features of QuickBooks Accountant. The company established a bank account, titled Union Checking, at the beginning of the year. In addition, the company filed for federal (91-3492370)

and state (234-3289-4) tax ID numbers. All employees are paid semimonthly but do not earn sick or vacation pay. All of their customers are product resellers and thus no state sales tax is collected. They don’t use estimates or progress invoicing but do use sales receipts, invoices, and statements. They keep track of the bills they owe but don’t print checks. They accept checks and credit cards as payment from customers but don’t keep detailed records of the time employees work. All state payroll taxes are paid to the Employment Development Department. The state unemployment tax (SUTA) rate is 3.4%, and the state disability tax rate is 1.1%.

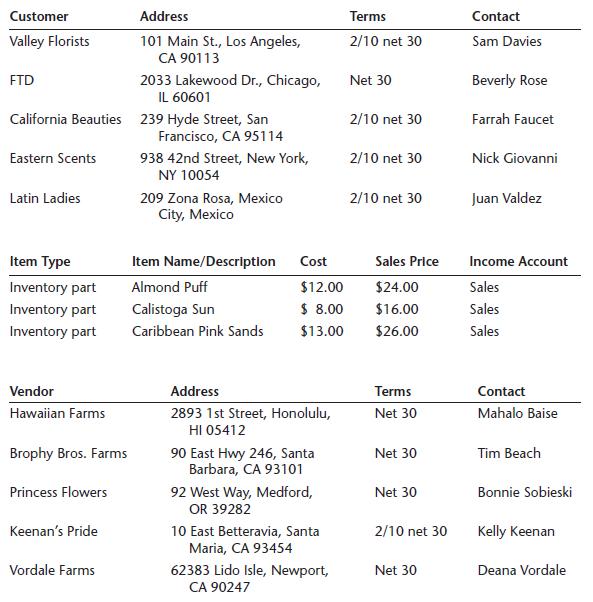

The company’s expected customers, items, and vendors are tabulated as follows:

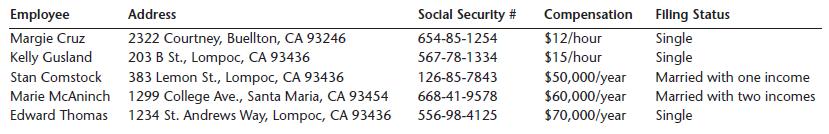

Ocean View Flowers employees (all of whom are considered regular-type employees)

were hired on 1/4/16 and are subject to federal and state taxes and withholdings, state unemployment, state disability, and state employee training taxes.

Two wage items are used: Hourly and Salary. The California wage plan code for all employees is U (Voluntary DI, State UI Plan). Payroll taxes are paid quarterly.

A list of employees is shown here.

Requirements:

Create a new company file for Ocean View Flowers using the EasyStep Interview.

Then add the customers, vendors, employees, accounts, items, and other information as just described. (Be sure to keep this QuickBooks Accountant file in a safe place; it will be used as a starting file for this case in Chapter 7.) Print the following as of 1/1/16:

1 Customer Contact List (Customer, Bill to, and Contact fields only)

2 Vendor Contact List (Vendor, Bill from, and Contact fields only)

3 Employee Contact List (Employee, SS No., and Address fields only)

4 Item List (Item, Description, Type, Cost, and Price fields only)

Step by Step Answer:

Using QuickBooks Accountant 2018 For Accounting

ISBN: 9780357042083

16th Edition

Authors: Glenn Owen