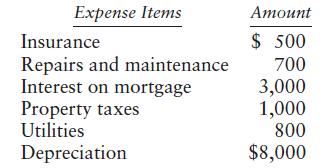

During the current year, Kim incurs the following expenses with respect to her beachfront condominium in Hawaii:

Question:

During the current year, Kim incurs the following expenses with respect to her beachfront condominium in Hawaii:

During the current year, Kim used the condominium 20 days for vacation. She rented it out for a total of 60 days, generating a total gross income of \($9,100\) .

a. What are the total amounts of deductions for and from AGI that Kim may take with respect to the condominium using the IRS allocation method?

b. What is the effect on the basis of the condominium?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson

Question Posted: