Jesse is a resident of New Jersey who works in New York City.He also owns rental property

Question:

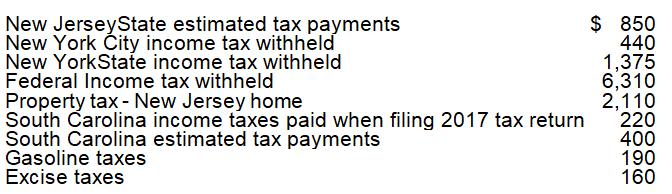

Jesse is a resident of New Jersey who works in New York City. He also owns rental property in South Carolina. During 2018, he pays the following taxes:

During 2018, Jesse’s 2016New YorkState and New York City tax returns are audited. Based on the audit, he pays an additional $250 in New York City taxes but receives a refund of $185 in New YorkState taxes. He also has to pay a $40 penalty and interest of $12 to New York City. However, he receives interest of $16 from New YorkState. What is Jesse’s allowable deduction for taxes in 2018?

Transcribed Image Text:

New JerseyState estimated tax payments New York City income tax withheld New YorkState income tax withheld Federal Income tax withheld Property tax - New Jersey home South Carolina income taxes paid when filing 2017 tax return South Carolina estimated tax payments Gasoline taxes Excise taxes $ 850 440 1,375 6,310 2,110 220 400 190 160

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (5 reviews)

Jesse is allowed to deduct as an itemized deduction all state and local income taxes and property taxes paid in 2018 regardless of which year they relate to The deduction is limited to 10000 The gasoline and excise taxes interest and penalties on the audited tax returns are not allowable taxes He is allowed to deduct 5645 as follows The federal income tax ...View the full answer

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Concepts In Federal Taxation

ISBN: 9781337702621

26th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted:

Students also viewed these Business questions

-

Jesse is a resident of New Jersey who works in New York City. He also owns rental property in South Carolina. During 2016, he pays the following taxes: New Jersey state estimated tax payments...

-

Jesse is a resident of New Jersey who works in New York City. He also owns rental property in South Carolina. During 2011, he pays the following taxes: New Jersey state estimated tax payments...

-

Jesse is a resident of New Jersey who works in New York City. He also owns rental property in South Carolina. During 2021, he pays the following taxes: During 2021, Jesses 2019 New York State and New...

-

Why do the requirements drift once a project is under way?

-

Under the Sarbanes-Oxley Act, what must the financial statement auditor do in relation to the companys internal control?

-

Perreth Products manufactures its products in two separate departments: machining and assembly. Total manufacturing overhead costs for the year are budgeted at $1 million. Of this amount, the...

-

Write requirements for the following products and services: a. Computer. b. Airplane. c. Food Processor. d. Online Banking e. Life Insurance. f. Party Planning.

-

On January 1, 2009, the Sato Company adopted the dollar-value LIFO method of inventory costing. The companys ending inventory records appear as follows: Required Compute the ending inventory for the...

-

Aloha Inc. has 7 percent coupon bonds on the market that have 12 years left to maturity. If the YTM on these bonds is 8.1 percent, what is the current bond price?

-

Using the data in the student spreadsheet file Ethan Allen financials.XLSX ( to find the student spreadsheets for financial Analysis with Microsoft Excel, eighth edition, go to...

-

Simon is single and a stockbroker for a large investment bank. During 2018, he has withheld from his paycheck $2,250 for state taxes and $400 for city taxes. In June 2019, Simon receives a state tax...

-

Determine the maximum deduction from AGI in 2018 for each of the following taxpayers: a. Selen is single and has itemized deductions for the year of $12,200. In addition, Selen's mother lives with...

-

A firm needs $1 million in additional funds. These can be borrowed from a commercial bank with a loan at 6 percent for one year or from an insurance company at 9 percent for five years. The tax rate...

-

Review the procedures for the district/school opening and closing of the school year. Observe or take an active part in these procedures. Critique the effectiveness and major concerns of the...

-

What is a strategic planning facilitator? What do you believe is the most important aspect of the facilitator's job? Explain why you believe this.

-

Identify the name of each of the poultry cuts along with the suitable style of cooking. Image Poultry cuts Style of cooking

-

What was Elton Mayo's most important improvement brought about by the Hawthorne studies?

-

Explain how the federal cash management system is considerably different from those of state and local governments ?

-

The marginal damage averted from pollution cleanup is MD = 200 5Q. The marginal cost associated with pollution cleanup is MC = 10 + Q. a. What is the optimal level of pollution reduction? b. Show...

-

Phosgene, COCl2, is a toxic gas used in the manufacture of urethane plastics. The gas dissociates at high temperature. At 400oC, the equilibrium constant Kc is 8.05 104. Find the percentage of...

-

Determine the taxpayer's adjusted basis in each of the following situations. If any changes are made in the original basis of the asset, explain why they are necessary. a. Simone purchases 300 shares...

-

Henrietta is the president and sole shareholder of Clutter Corporation. In 2013, Henrietta transferred ownership of her personal residence to the corporation. As part of the transfer, Clutter...

-

Aretha is an executive vice president of Franklin, Inc. On December 18, 2016, the Franklin, Inc., board of directors awards her a $20,000 bonus. Aretha asks Franklin's controller to delay processing...

-

Identify the assets and prioritization of those assets. (Assets can be information, tools, servers, applications, personnel, etc.) Evaluate the threats, including impact and likelihood. Evaluate...

-

Companies are collecting personal data and selling it to third-party companies. Currently, some states have laws that protect the privacy of the consumers of that state. On January 1, 2023, the...

-

Calculate the perimeter and area for each triangle. 3.6 cm 15.4 in 17.1 in 3.2 cm P = ? cm A = ? cm 16.1 in P-7 in A = ? in

Study smarter with the SolutionInn App