Julie Hernandez is single and has no dependents. She operates a dairy farm and her Social Security

Question:

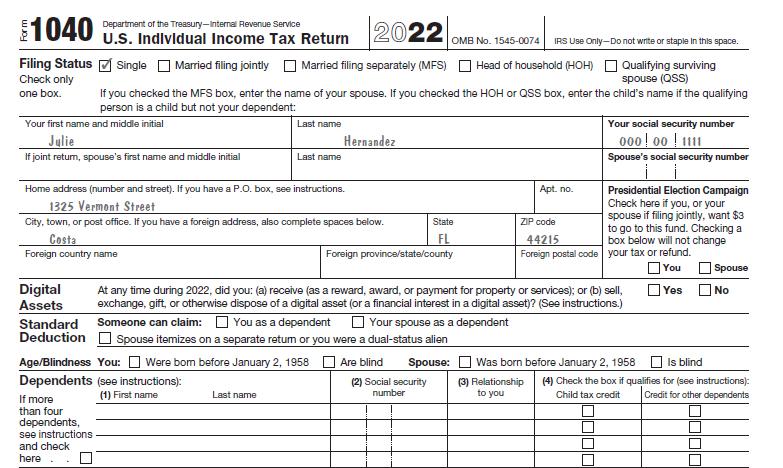

Julie Hernandez is single and has no dependents. She operates a dairy farm and her Social Security number is 000-00-1111. She lives at 1325 Vermont Street in Costa, Florida, 44215. Consider the following information for the current year:

• Schedule C was prepared by her accountant and the net profit from the dairy operations is \($48,000\) .

• Itemized deductions amount to \($4,185\).

• Dividend income (qualified dividend) amounts to \($280.\) She had no transactions involving virtual currency during the year.

• State income tax refund received during the year is \($125.\) She did not itemize last year.

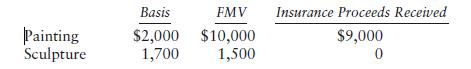

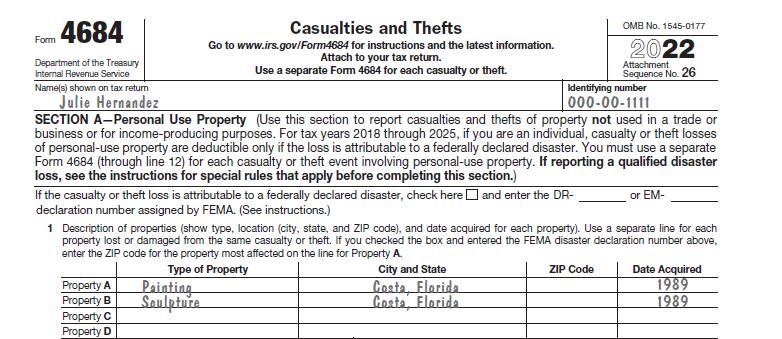

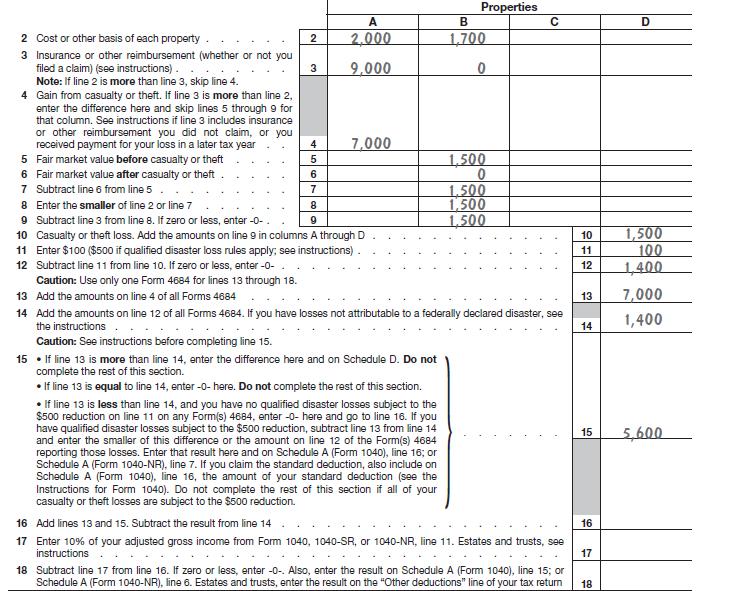

• In June, a burglar broke into her house and stole the following two assets, which were acquired in 1989:

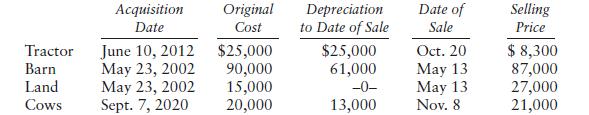

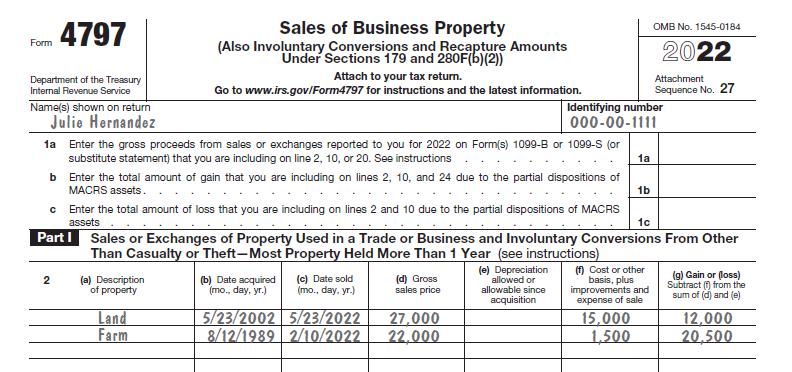

The following assets used in her business were sold during the year:

In August, three acres of the farm were taken by the state under the right of eminent domain for the purpose of building a highway. The basis of the three acres is \($1,500,\) and the state paid the FMV, \($22,000,\) on February 10. The farm was purchased on August 12, 1989.

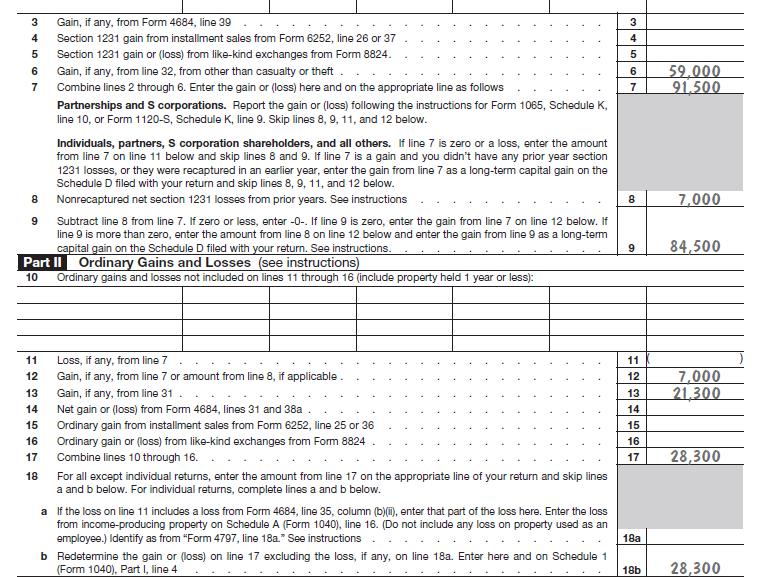

Non recaptured net Section 1231 losses from the five most recent tax years preceding the current year amount to \($7,000.\) Estimated taxes paid during the year amount to \($32,000\) . Prepare Forms 1040, 4684 Section A, 4797, and Schedule D.

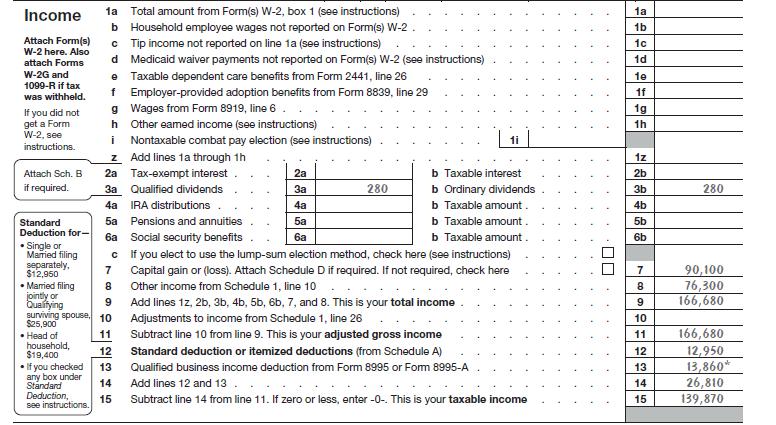

Data From Form 1040

Data From Form 4684

Data From Form 4797

Step by Step Answer:

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson