Latoya is an independent contractor and operates her own successful consulting business in Milwaukee. She has just

Question:

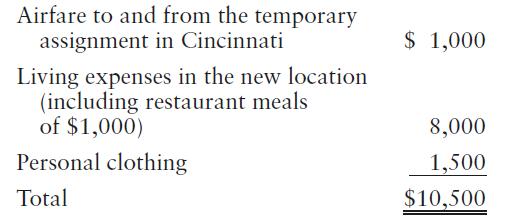

Latoya is an independent contractor and operates her own successful consulting business in Milwaukee. She has just signed a large contract with a new client that will require her to spend nine months in Cincinnati. Latoya leaves her husband and children in Milwaukee and incurs the following expenses in connection with the temporary assignment:

a. Which (if any) of these items can Latoya deduct in 2023?

b. Would your answer to Part a change if Latoya, after completing the nine month assignment, needed to spend an additional six months in Cincinnati?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson

Question Posted: