Limestone Corporation is a C corporation that uses the calendar year as its tax year. Its employer

Question:

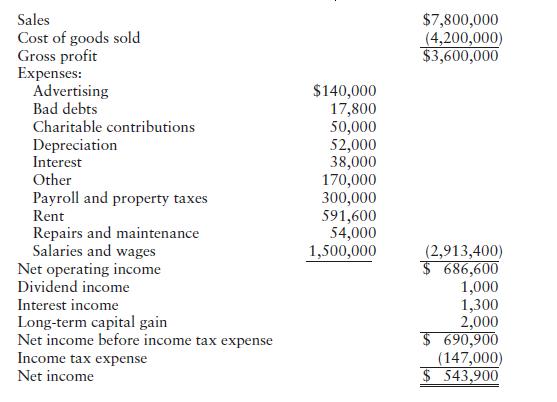

Limestone Corporation is a C corporation that uses the calendar year as its tax year. Its employer identification number is 44-1357913. Limestone is located at 234 Main Street, Anytown, New York 12345 and was incorporated on May 13, 1991. Limestone reports its financial accounting net income for 2022 as follows:

Additional information is available regarding Limestone’s income statement items:

• Bad debt expense for federal income tax purposes (direct write-off method) is \($17,000.

•\) The charitable contributions were cash. Limestone has a \($32,000\) charitable contributions carryover from 2021 to 2022.

• Depreciation for federal income tax purposes is \($114,600.

•\) Other expenses include a \($10,000\) nondeductible fine.

• \($300,000\) of the salaries and wages are for its officers.

• The dividends were received from domestic corporations. Limestone owns less than 20% of their stock. Limestone sold this stock during the year, realizing the \($2,000\) long-term capital gain.

• \($900\) of the interest income is taxable, and \($400\) of it is tax-exempt.

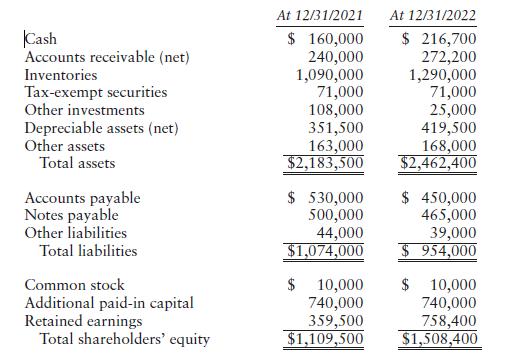

Limestone reports the following financial accounting balance sheets for the end of 2021 and the end of 2022:

Additional information is available regarding Limestone’s balance sheet items:

• At the end of 2021, accounts receivable was \($250,000\) and the allowance for bad debts was \($10,000.\) At the end of 2022, accounts receivable was \($283,000\) and the allowance for bad debts was \($10,800.

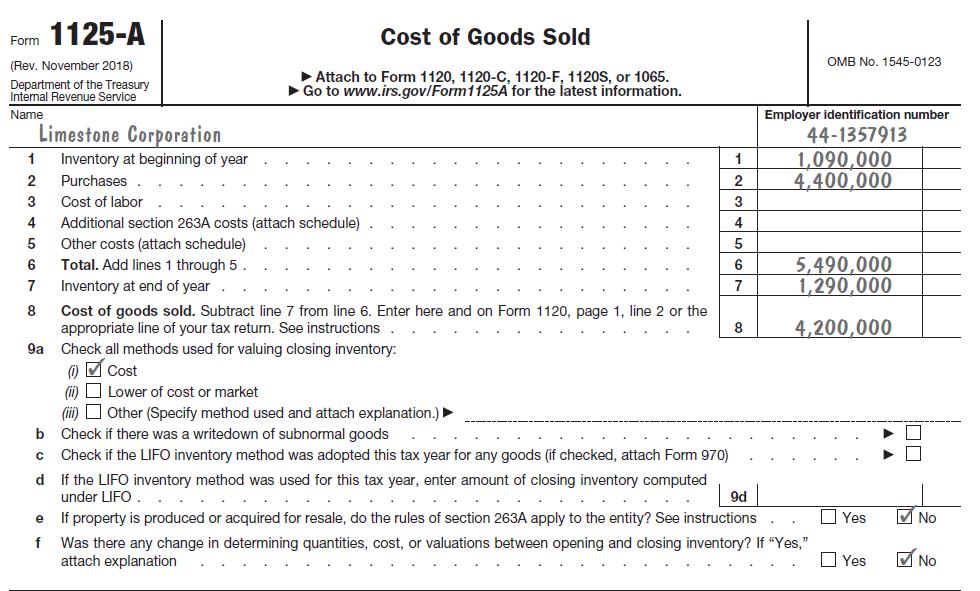

•\) Limestone uses the cost method and FIFO for its inventory costs. It is not subject to the rules of Sec. 263A, and it did not change its methods for determining inventory costs.

• At the end of 2021, depreciable assets were \($370,000\) and accumulated depreciation was \($18,500.\) At the end of 2022, depreciable assets were \($490,000\) and accumulated depreciation was \($70,500.

•\) The note payable is due in three years, but Limestone paid back some of it during 2022.

• The retained earnings are unappropriated.

During 2022, Limestone purchased \($4.4\) million of inventory and paid \($145,000\) of cash dividends. It made \($140,000\) of timely estimated tax payments for 2022 and wants any overpayment to be credited to its 2023 estimated tax.

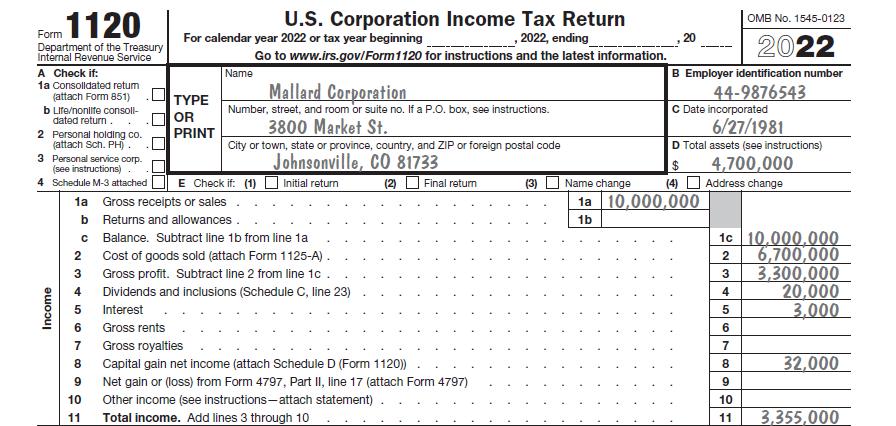

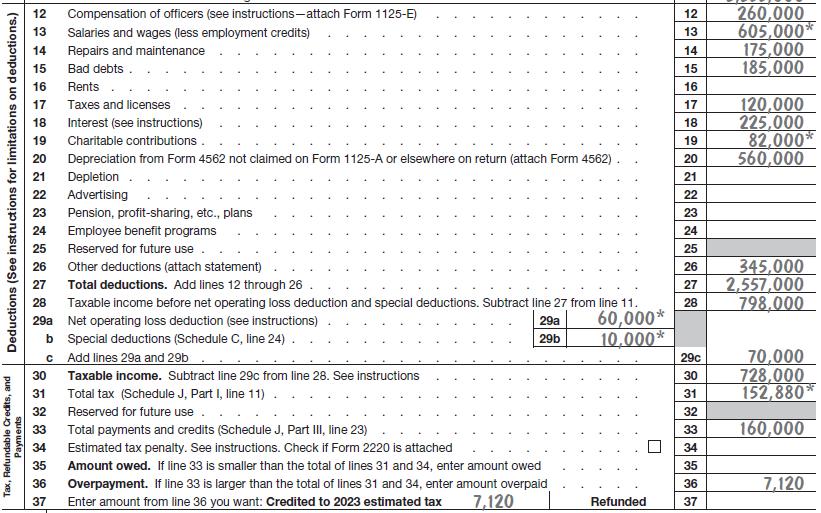

Prepare the following portions of Limestone’s 2022 federal income tax return:

• Form 1120, page 1 • Form 1120, Schedules C, J, L, M-1, and M-2 • Form 1125-A

Data From Form 1120

Data From Form 1125-A

Step by Step Answer:

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson