Marilyn, an independent contractor who lives and works in Cleveland, obtains a large contract that will require

Question:

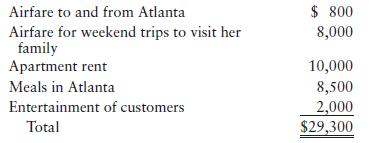

Marilyn, an independent contractor who lives and works in Cleveland, obtains a large contract that will require her to live and work in Atlanta for a period of ten months. Marilyn leaves her husband and children in Cleveland and rents an apartment in Atlanta during the ten-month period. Marilyn incurs the following expenses:

a. What are Marilyn’s total deductions for 2023?

b. Are the expenditures classified as for AGI or from AGI deductions?

c. Do the tax consequences change if Marilyn’s assignment is for a period of more than one year?

d. Do the tax consequences in Parts a through c change if it was realistically expected that the work would be completed in ten months but after the ten-month period Marilyn is asked to continue for seven more months and if an additional \($10,000\) of travel expenses are incurred during the extended period?

Step by Step Answer:

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson