Michelle is self-employed and uses her personal automobile for business trips. During 2023, Michelle drives her car

Question:

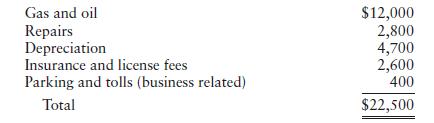

Michelle is self-employed and uses her personal automobile for business trips. During 2023, Michelle drives her car 60% for business use and incurs the following total expenses (based on 100% use of car):

Michelle drives her car a total of 40,000 miles (24,000 business miles) during 2023.

a. What amount is deductible if Michelle uses the standard mileage method?

b. What amount is deductible if Michelle uses the actual cost method?

c. Can taxpayers switch back and forth between the mileage and actual methods each year?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson

Question Posted: